What You Need to Know About Renters Insurance

Anúncios

Renters insurance is frequently an overlooked necessity for individuals residing in rental properties. It offers critical protection for personal belongings and provides liability coverage, thereby ensuring peace of mind in the event of unforeseen incidents such as theft or damage.

This article elucidates what renters insurance entails, its significance, and the various coverage options available. Additionally, it offers guidance on selecting the appropriate policy and clarifying common terminology, enableing readers to make informed decisions that protect their homes and belongings.

What is Renters Insurance?

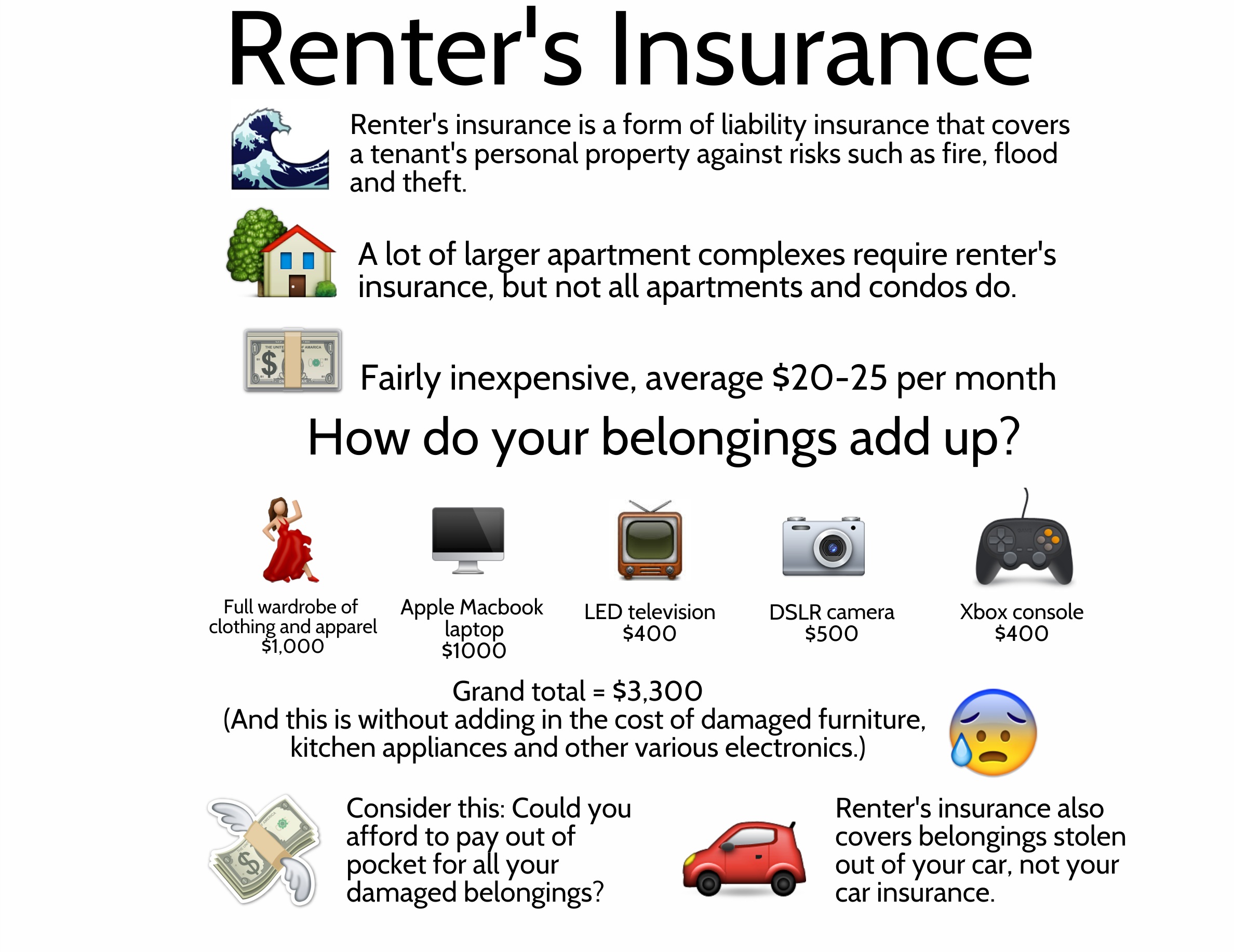

Renters insurance is a specialized insurance policy created to protect tenants and their personal belongings within rented properties, providing essential financial protection against various risks.

This coverage not only secures personal property from theft and damage but also includes liability protection in the event of accidents occurring within the rental unit.

Anúncios

It is imperative for tenants to understand the intricacies of renters insurance, as this knowledge aids them in navigating landlord requirements and fulfilling their legal obligations while ensuring comprehensive protection for their household items.

Definition and Coverage

Renters insurance provides essential coverage for tenants, offering protection for personal property against theft, damage, and other unforeseen events, while also outlining specific policy exclusions.

This type of insurance is particularly valuable as it typically encompasses not only personal belongings but also provides liability protection in the event that an individual is injured within the rented space. Along with safeguarding against theft, renters insurance may extend to cover losses caused by natural disasters, such as fire, windstorms, or hail, which can significantly affect a tenant’s possessions.

It is important to recognize that while many policies offer broad coverage, there are often limits to the reimbursement amounts for high-value items, and certain exclusions may apply, such as damages resulting from floods and earthquakes.

Tenants are encouraged to thoroughly review their policies to ensure they adequately meet their individual needs and to consider supplemental coverage if necessary.

Why Renters Insurance is Important

Renters insurance is essential for tenants as it offers vital financial protection against unforeseen events such as theft, fire, and water damage, thereby safeguarding personal belongings and providing peace of mind in an often unpredictable rental environment.

Furthermore, by offering liability coverage, renters insurance assists tenants in fulfilling their legal responsibilities and obligations, protecting them from potential financial liabilities arising from accidents that may occur within their rented premises.

Benefits and Protection

The benefits of renters insurance extend beyond the mere protection of personal belongings; it also provides coverage for additional living expenses in the event that the rental unit becomes uninhabitable. Furthermore, it offers personal liability protection, which addresses claims related to damages or injuries occurring on the property.

In the unfortunate circumstance that a fire or other disaster necessitates the residents’ relocation from their home, renters insurance can assist in covering expenses such as hotel accommodations and food costs until the situation is resolved.

Additionally, it serves as a safeguard against potential lawsuits that may arise if an individual is injured within the rental space, ensuring that financial responsibilities do not rest solely on the tenant.

Navigating the insurance claims process can be straightforward, particularly when selecting an insurer that provides responsive customer service. Moreover, many insurance providers offer discounts for bundling policies or maintaining a claims-free history, thereby enhancing the financial advantages of securing renters insurance.

What Does Renters Insurance Cover?

Renters insurance includes a range of coverage options designed to protect personal belongings and property from various risks, such as theft, fire, and natural disasters.

This coverage provides homeowners with peace of mind in unforeseen circumstances. A comprehensive understanding of the specifics of what is covered can assist tenants in effectively navigating their policies, thereby ensuring they obtain the appropriate protection for their household items.

Types of Coverage and Examples

Renters policies offer a range of coverage options, including contents coverage for personal belongings, theft coverage for valuable items, and additional endorsements that enhance protection based on the individual needs of the policyholder.

Contents coverage serves to protect not only furniture and electronics but also personal items such as clothing and jewelry from risks associated with damage or loss.

Theft coverage provides tenants with peace of mind by reimbursing them for stolen possessions, which is essential for maintaining financial stability following an unexpected loss.

Endorsements allow renters to customize their policies; for example, incorporating a high-value items endorsement offers additional protection for expensive collectibles or technological devices. Other endorsements may include liability coverage, which safeguards against potential legal claims, thereby ensuring that tenants feel secure in their living environment.

How to Choose the Right Renters Insurance

Selecting the appropriate renters insurance necessitates a thorough evaluation of several factors, including a personal risk assessment, an understanding of coverage needs, and a comparison of renters insurance quotes from various providers.

This process is essential to ensure optimal protection at a competitive price. By carefully assessing coverage options and performing a comprehensive insurance comparison, tenants can identify the most suitable policy tailored to their specific requirements.

Factors to Consider

When evaluating renters insurance options, it is essential to consider several key factors, including the insurance premium, the deductible amount, coverage limits, and any potential liability issues that may arise during the policy period. These elements play a critical role in determining the overall affordability and effectiveness of the coverage.

The insurance premium represents the cost associated with the policy and is often influenced by various factors such as geographic location and the insured’s claims history. The deductible, which is the out-of-pocket expense a policyholder must pay prior to the activation of coverage, directly affects the amount received after a loss.

It is important to assess coverage limits carefully; inadequate limits may result in financial vulnerability. Additionally, being aware of liability implications can provide protection against unforeseen incidents. Understanding how these factors impact policy renewal is also crucial in order to avoid any unexpected complications in the future.

Understanding Renters Insurance Policies

A comprehensive understanding of renters insurance policies is essential for tenants, as it enables them to navigate the complexities of their coverage options, policy exclusions, and legal obligations effectively.

This knowledge is crucial for ensuring that tenants are adequately protected against potential risks and can access available insurance assistance when necessary.

Common Terms and Exclusions

Common terms and exclusions in renters insurance policies pertain to personal belongings and may reveal coverage gaps for specific items or situations, such as natural disasters or certain types of damage.

These coverage gaps often arise from factors such as location-specific risks or the inherent vulnerabilities associated with particular possessions. For instance, while standard policies typically provide protection against theft or fire, they generally exclude damage resulting from flooding or earthquakes, which can place renters at considerable financial risk.

High-value items, including jewelry, artwork, or electronics, may necessitate additional riders or separate coverage to ensure comprehensive protection. Understanding these exclusions is essential, as they directly influence the effectiveness of a policy in safeguarding important personal belongings from unforeseen events.

Cost of Renters Insurance

The cost of renters insurance can vary considerably based on several factors, including the chosen insurance premium, the deductible amount, and the individual risk management strategies employed by tenants to mitigate potential losses.

A comprehensive understanding of these factors enables tenants to make informed decisions that align with their budgetary constraints and coverage requirements.

Factors that Affect Premiums

Several factors influence the insurance premium of a renters policy, including the chosen deductible amount, coverage limits, and a comprehensive risk assessment that takes into account the tenant’s living environment and existing security measures.

Understanding these elements is crucial for tenants who seek optimal protection for their personal belongings. For instance, selecting a lower deductible may result in a higher premium, whereas opting for a higher deductible often leads to reduced monthly costs. This allows tenants to effectively balance their expenses and coverage based on their individual financial situations.

Coverage limits also have a significant impact on premiums; choosing appropriate limits ensures that tenants are adequately protected against potential losses. Important considerations include the location of the rental property, the presence of security features such as alarms or deadbolts, and the tenant’s claims history, all of which play critical roles in determining premiums.

In conclusion, tenant insurance represents a prudent decision for safeguarding personal possessions and providing peace of mind.

Frequently Asked Questions

What You Need to Know About Renters Insurance

Renters insurance is a type of insurance policy that provides coverage for the personal belongings and liability of individuals who are renting a property. It is important to understand the basics of renters insurance to ensure that you have adequate coverage in case of any unexpected events.

What does renters insurance cover?

Renters insurance typically covers the cost of replacing or repairing personal belongings in case of damage or loss due to covered events such as fire, theft, or natural disasters. It also provides liability coverage in case someone is injured on your rental property and you are held responsible for their medical expenses or legal fees.

Do I really need renters insurance?

While renters insurance is not legally required, it is highly recommended for anyone who is renting a property. Without renters insurance, you would be fully responsible for the cost of replacing your belongings in case of a disaster or paying for any liability claims made against you.

How much does renters insurance cost?

The cost of renters insurance varies depending on factors such as your location, the value of your belongings, and the coverage limits you choose. On average, renters insurance can cost anywhere from $15 to $30 per month.

Can I add roommates to my renters insurance policy?

In most cases, you can add roommates to your renters insurance policy. However, it is important to consult with your insurance provider to make sure that everyone is properly covered and to avoid any potential coverage gaps.

What are some common misconceptions about renters insurance?

One common misconception about renters insurance is that it only covers the belongings inside your rental unit. In reality, it can also provide coverage for your belongings outside of your rental property, such as in your car. Another misconception is that renters insurance is expensive, when in fact, it is often more affordable than people realize.