What to Consider When Buying International Travel Insurance

Anúncios

When planning a trip abroad, one of the most critical considerations is international travel insurance. This type of insurance serves as a safety net, providing peace of mind against unforeseen circumstances such as medical emergencies, trip cancellations, or lost luggage.

This guide examines international travel insurance, outlining its definition, significance, and the process for selecting the appropriate policy to meet your needs. From comprehending various coverage options to receiving guidance on filing claims, this resource aims to equip you with the knowledge necessary for a worry-free journey.

Understanding International Travel Insurance

Comprehending international travel insurance is essential for travelers seeking protection against unforeseen events during their journeys. This type of insurance provides a range of coverage options designed to safeguard individuals from potential travel risks.

It includes critical components such as medical expenses, trip cancellation, travel delays, and emergency evacuation, enabling travelers to embark on their adventures with confidence.

Anúncios

Furthermore, being well-informed about the claims process and the assistance services offered by insurance companies can greatly enhance the travel experience, allowing individuals to manage emergencies effectively while abroad.

What is International Travel Insurance?

International travel insurance is a specialized policy crafted to provide financial protection against unforeseen events that may arise while traveling outside one’s home country, addressing various risks associated with travel. This insurance typically encompasses coverage for medical expenses, trip interruptions, cancellations due to unexpected circumstances, and other travel-related incidents, all aimed at ensuring that travelers are adequately prepared for potential challenges during their journeys.

A comprehensive policy often includes options such as coverage for lost luggage, personal liability, and emergency evacuation, which are vital for mitigating the high costs of healthcare abroad. It is essential for travelers to be cognizant of specific exclusions, such as pre-existing medical conditions or high-risk activities, as these may expose them to additional vulnerabilities.

Understanding the intricacies of premiums is equally important, as they reflect the extent of coverage provided and can vary based on factors including age, destination, and trip duration. Ultimately, possessing knowledge about these elements give the power tos travelers to make informed decisions, ensuring they select a policy that aligns with their individual needs.

Why You Need International Travel Insurance

Investing in international travel insurance is essential for travelers seeking to protect their journeys from unexpected circumstances.

The advantages of having travel insurance are significant, as it offers critical financial support in the event of trip cancellations due to unforeseen events, travel delays, and medical emergencies.

With coverage for medical expenses and emergency evacuation, travelers can secure their safety and well-being, enabling them to concentrate on enjoying their experiences without the ongoing concern of potential travel mishaps.

Benefits of Having Travel Insurance

Travel insurance provides numerous benefits that offer peace of mind and financial security for travelers during their journeys.

One of the primary advantages is comprehensive coverage, which protects against trip interruptions, lost luggage, and personal liability. Access to assistance services ensures that travelers receive the necessary support in emergencies, whether that involves medical assistance or legal guidance, thereby contributing to their financial stability while traveling abroad.

This type of protection becomes invaluable when unexpected challenges arise while exploring new destinations. Consider the scenario of being in a foreign country and facing a sudden illness or an unforeseen event that disrupts carefully laid plans; having travel insurance facilitates swift and efficient solutions.

Customer reviews frequently highlight how this insurance alleviated their concerns, particularly when dealing with unexpected costs or arranging alternative travel. Ultimately, the reassurance provided by comprehensive coverage not only enhances the travel experience but also fosters a sense of confidence in exploration.

Factors to Consider When Choosing Travel Insurance

Selecting the appropriate international travel insurance requires a thorough assessment of various factors to ensure comprehensive protection tailored to your travel needs.

Important considerations include the range of coverage options offered, policy limits, and specific exclusions that may impact the claims process.

Furthermore, the financial stability of the insurance provider is essential, as it directly influences the reliability of claims assistance and the overall quality of service during your travels.

Coverage Options

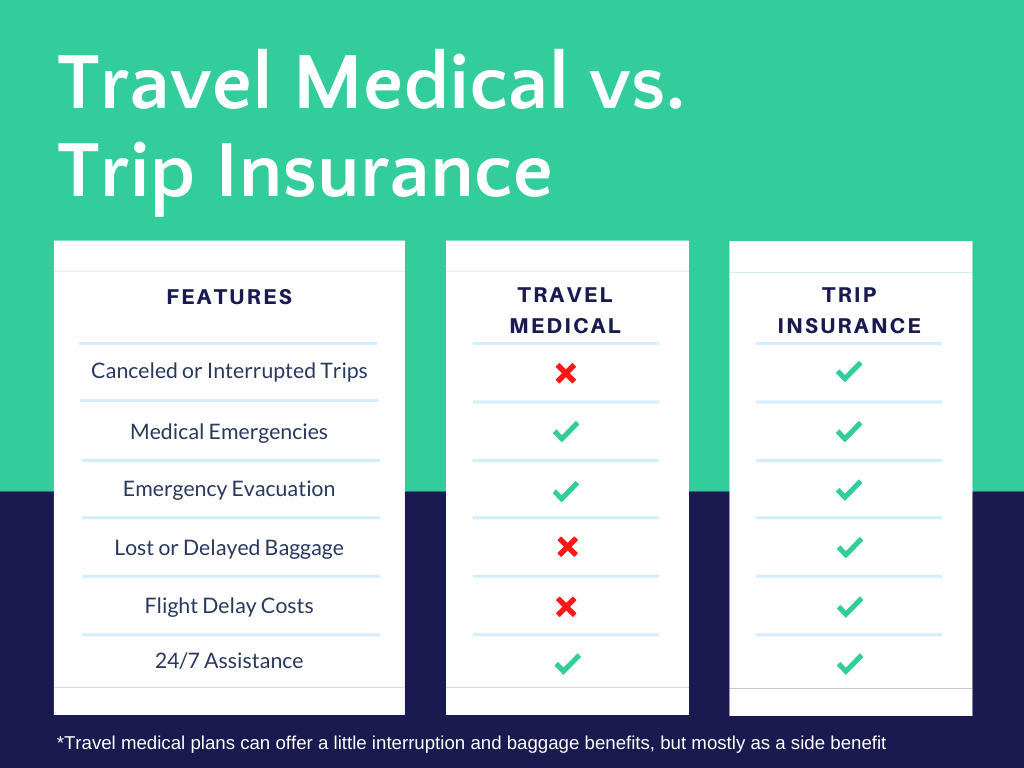

When selecting international travel insurance, it is imperative to understand the various coverage options available to effectively mitigate potential travel risks. Policies can vary significantly, offering specific coverage for medical expenses, trip cancellations, travel delays, emergency evacuations, and even adventure activities. The geographical coverage provided by a policy can greatly impact its effectiveness, underscoring the importance of choosing a plan that aligns with one’s travel destination and intended activities.

For example, travelers participating in adventure sports such as scuba diving, skiing, or rock climbing should seek policies that specifically include coverage for these activities, as many standard plans may exclude such high-risk pursuits.

Furthermore, understanding the nuances of geographical limitations can ensure that travelers are adequately covered in remote areas or regions that are prone to natural disasters.

Flexibility in policy terms is also crucial, as it allows for adjustments in response to changing travel plans or unforeseen circumstances.

By comprehensively grasping these elements of international travel insurance, individuals can embark on their journeys with greater peace of mind and security, regardless of their chosen destinations.

Policy Limits and Exclusions

Understanding the policy limits and exclusions of international travel insurance is essential for ensuring adequate protection while traveling. Policy limits refer to the maximum amount an insurer is willing to pay for specific claims, whereas exclusions outline the circumstances that are not covered under the policy, such as pre-existing conditions.

Additionally, factors such as deductibles and co-insurance can influence the overall cost and accessibility of benefits, making it imperative to review these details meticulously.

Comprehending these components can significantly enhance an individual’s protection during unexpected situations. For example, in the event of a medical emergency, awareness of the extent of coverage can provide considerable peace of mind.

Common exclusions, particularly those related to adventure sports or specific activities, may lead to unexpected expenses if not thoroughly understood in advance. The implications of deductibles and co-insurance are equally critical; travelers must recognize that higher out-of-pocket costs may arise during the claims process, impacting their financial planning.

By dedicating time to understand these elements, travelers can bolster their security and mitigate potential pitfalls.

Cost and Premiums

The cost of international travel insurance is frequently influenced by a variety of factors, including premium rates that depend on the duration of the trip, destination, and the individual’s profile, such as age restrictions or family coverage requirements.

Conducting a comprehensive insurance comparison and obtaining quotes from multiple providers is essential in identifying the most suitable plan that aligns with one’s budget and travel needs, thereby facilitating an well-considered choices process.

Additional factors, such as pre-existing medical conditions, coverage limits, and the range of benefits included, can further affect pricing. For instance, older travelers may encounter higher premiums due to increased risk factors, while those seeking comprehensive coverage may find that plans offering extensive benefits are reflected in their quotes.

Carefully reviewing these elements during an insurance comparison enables travelers to assess the overall value of their options and customize their policy accordingly, ensuring both adequate protection and financial prudence while navigating international destinations.

How to Purchase International Travel Insurance

Acquiring international travel insurance is a systematic process that necessitates a thorough understanding of one’s travel requirements and the selection of an appropriate policy to ensure comprehensive coverage.

Individuals can navigate the purchasing process through multiple channels, including online platforms, insurance brokers, and travel partners. Each of these avenues offers distinct payment options and customer support to assist in identifying the most suitable policy language for one’s journey.

Where to Buy and What to Look For

Understanding where to purchase international travel insurance can significantly enhance one’s travel experience, as various options exist, including online comparison websites, travel partners, and insurance brokers.

When selecting a provider, it is crucial to seek comprehensive coverage, favorable claims documentation, and positive customer reviews, ensuring the choice of a reliable option that aligns with the traveler’s specific needs.

Today’s travelers benefit from the convenience of numerous platforms that facilitate easy side-by-side comparisons of insurance policies. Conducting thorough research is essential not only for evaluating pricing but also for assessing critical factors such as the extent of coverage and the provider’s reputation.

By examining customer feedback, individuals can gain valuable insights into actual claims experiences, which can reveal potential issues or advantages associated with specific insurance companies.

Meticulous documentation of any claims during travel is advisable to ensure a smoother process in the event of an incident, thereby underscoring the importance of making informed decisions regarding insurance.

Tips for Using International Travel Insurance

Effectively utilizing international travel insurance necessitates a comprehensive understanding of the claims process and preparation for potential emergencies that may arise during one’s trip.

Travelers are advised to keep all pertinent travel documents easily accessible and to maintain an emergency contact list to facilitate prompt claims assistance when necessary.

A solid understanding of insurance terminology is essential for navigating the terms of the policy and ensuring that travelers are well-informed about the appropriate steps to take in the event of a travel-related incident.

Making Claims and Understanding Coverage

Submitting claims under international travel insurance can be a straightforward process, provided that one understands the necessary documentation and coverage limits specified in the policy. Familiarizing oneself with the claims process in advance, including the types of documentation required for claims, can significantly expedite settlements and ensure a seamless experience during critical times.

It is essential for travelers to collect pertinent items such as receipts, medical reports, and police reports, as these documents are vital in substantiating the claims submitted. Understanding the specific terminology used in the policy aids in comprehending the nuances related to exclusions and deductibles.

Maintaining open lines of communication with the insurance provider can facilitate prompt responses to inquiries or clarifications regarding coverage. By grasping policy terms such as “covered events” and “insurance ratings,” travelers can more effectively advocate for themselves and navigate any potential disputes that may arise during the claims process.

Frequently Asked Questions

What to consider when buying international travel insurance?

When buying international travel insurance, it is important to consider the coverage options, cost, and exclusions of the policy. You should also take into account the length of your trip, your destination, and any pre-existing medical conditions you may have.

What type of coverage should I look for?

When purchasing international travel insurance, you should look for a policy that provides coverage for medical emergencies, trip cancellation or interruption, baggage loss or delay, and emergency evacuation. Depending on your needs, you may also want to consider additional coverage for activities such as adventure sports or rental car accidents.

How much should I expect to pay for international travel insurance?

The cost of international travel insurance varies based on factors such as your age, trip length, and coverage options. On average, a comprehensive policy can cost anywhere from 4-10% of your total trip cost. It is important to compare quotes from different providers to find the best price for your needs.

What exclusions should I be aware of?

Before purchasing international travel insurance, make sure to carefully review the policy’s exclusions. Common exclusions may include pre-existing medical conditions, high-risk activities, and countries with travel warnings or advisories. It is important to understand what is not covered in order to avoid any surprises during your trip.

Do I need international travel insurance if I already have medical insurance?

While your medical insurance may provide coverage for emergencies abroad, it is important to check the details of your policy. Most domestic health insurance plans have limited coverage outside of your home country, and may not cover other travel-related incidents such as trip cancellation or lost luggage. It is recommended to purchase international travel insurance for added peace of mind.

What should I do if I need to make a claim?

If you need to make a claim on your international travel insurance policy, it is important to follow the specific instructions outlined by your provider. Typically, you will need to provide documentation such as receipts and proof of loss or injury. It is important to keep all receipts and documentation during your trip in case you need to make a claim upon your return.