Top Reasons to Get Homeowners Insurance

Anúncios

Homeowners insurance serves as a vital safeguard for both your property and your peace of mind. This article aims to provide a comprehensive overview of homeowners insurance, detailing the various types available and the coverage they offer.

It will discuss the importance of this insurance for financial protection, common claims that homeowners may encounter, and key factors to consider when selecting the appropriate policy to meet individual needs. Additionally, strategies will be presented to help reduce premiums, ensuring that homeowners are well-prepared to protect their most valuable asset.

What is Homeowners Insurance?

Homeowners insurance is a comprehensive property insurance product that provides protection against a range of risks associated with homeownership, including property damage, liability claims, and other unforeseen events.

This type of insurance is vital for homeowners, as it safeguards their valuable assets and ensures financial stability in the face of disasters such as fire damage, theft, or natural calamities.

Anúncios

Additionally, it offers peace of mind by covering personal belongings and the structural integrity of the home through various policy options tailored to meet the specific needs and requirements of the homeowner.

Definition and Coverage

Homeowners insurance offers critical property protection through a combination of dwelling coverage, liability coverage, and personal property coverage, which collectively safeguard homeowners’ assets.

This comprehensive coverage not only addresses structural damage to the home itself, such as that caused by fire or severe weather, but also extends to liabilities in the event of injuries sustained on the property, thereby ensuring financial security for homeowners in the case of an accident.

For example, if a tree were to fall on the house during a storm, the dwelling coverage would assist in repairing the resulting damage, while the liability insurance would provide protection against potential claims from visitors who may be injured on the premises.

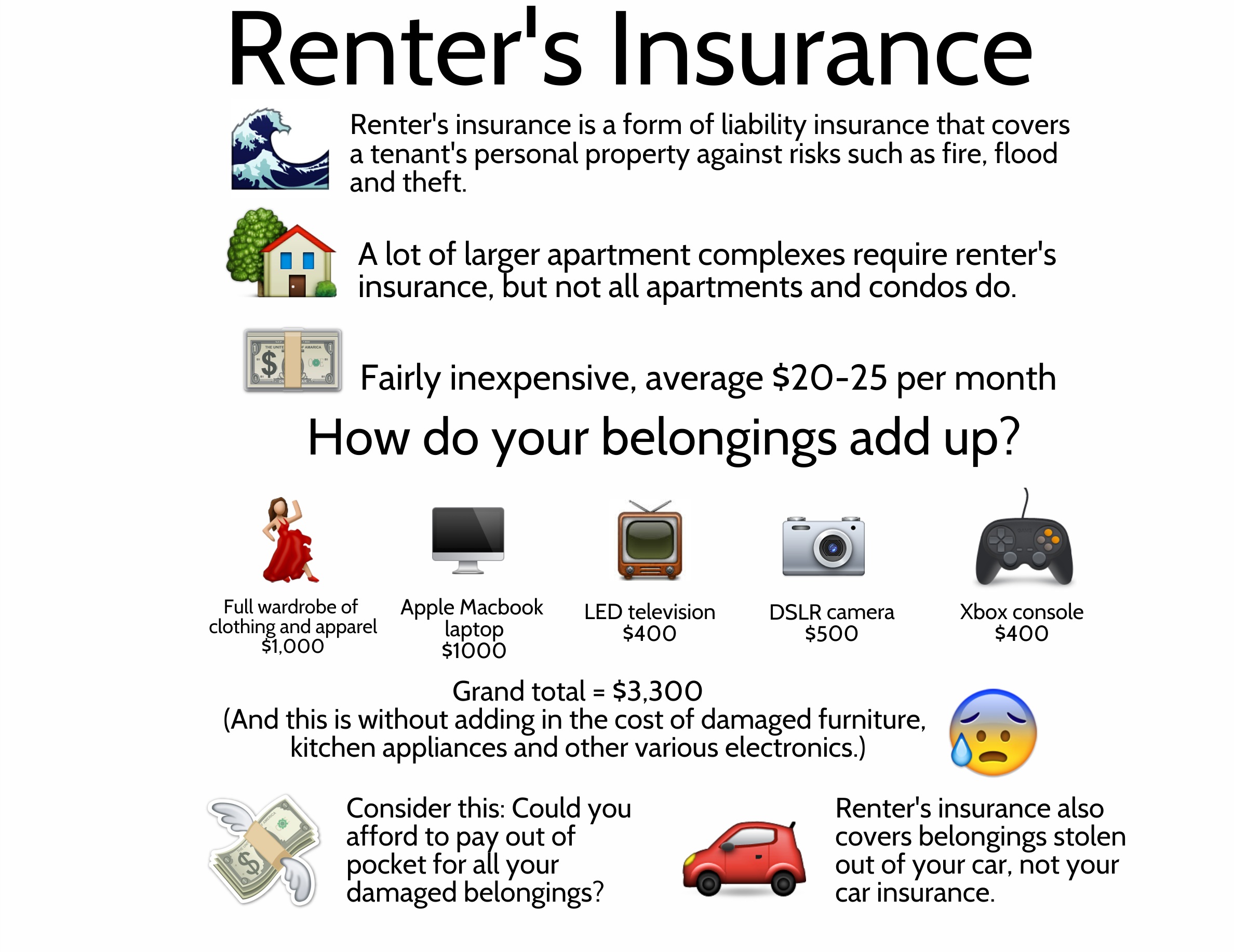

Furthermore, personal property protection safeguards belongings against theft or damage, offering reassurance that items such as electronics, furniture, and sentimental valuables are protected from unexpected losses.

Why is Homeowners Insurance Important?

Homeowners insurance is essential for individuals who own property, as it provides comprehensive financial protection against substantial losses arising from property damage, legal liabilities, and unforeseen events that may jeopardize financial stability.

This insurance offers homeowners reassurance by safeguarding them against liability claims and securing their investments.

In an unpredictable environment, possessing reliable coverage enables homeowners to recover from disasters—such as fire damage, natural disasters, or theft—thereby protecting both the value of their property and their personal belongings.

Financial Protection and Peace of Mind

The financial protection provided by homeowners insurance not only preserves the value of the home but also offers homeowners peace of mind by safeguarding them against potential losses arising from various unforeseen incidents.

In times of crisis, such as following a natural disaster or unexpected event, this insurance serves as a critical safety net, alleviating the financial burden of repair costs and enabling homeowners to concentrate on rebuilding their lives.

Moreover, the emotional benefits of homeowners insurance are significant; the assurance of having a support system in place cultivates a sense of security during uncertain times.

Many policies also cover additional living expenses, ensuring that in the event of significant damage, the costs associated with temporary housing are managed, allowing families to avoid the added stress of financial strain as they navigate the recovery process.

Types of Homeowners Insurance

Understanding the various types of homeowners insurance policies is essential for homeowners who aim to customize their coverage to meet specific needs.

These policies include standard options, comprehensive coverage, and additional endorsements. Each type provides different levels of protection, which depend on factors such as coverage limits, deductibles, and the nature of the property.

By thoroughly exploring these options, homeowners can make informed decisions that align with their financial planning and risk assessment requirements, thereby ensuring both asset security and adequate liability coverage.

Understanding the Different Policies

Different homeowners insurance policies, ranging from HO-1 to HO-8, provide distinct coverage options that are specifically designed to address the diverse needs of homeowners and various property types, thereby influencing both premiums and coverage limits.

Each policy type encompasses specific features and exclusions, catering to different demographics and geographic factors. For example, the HO-3 policy is notably popular due to its broader range of coverage compared to the more basic HO-1 form, which only offers limited protection for specific perils.

Understanding these distinctions is essential, as the choice of policy significantly impacts the extent to which one’s home and belongings are safeguarded against common risks such as theft, fire, or natural disasters.

Furthermore, this understanding is instrumental in determining deductibles and premiums, underscoring the necessity for homeowners to carefully assess their individual circumstances, assets, and potential risks when selecting the most suitable insurance plan.

Factors to Consider When Choosing Homeowners Insurance

When selecting homeowners insurance, it is essential to consider several critical factors, including risk assessment based on location, property value, and the reputation of the insurance companies. These elements significantly influence policy options and costs.

Homeowners should carefully evaluate their individual circumstances, including neighborhood safety and potential risks such as natural disasters, to determine the appropriate level of coverage.

A comprehensive understanding of these factors enables homeowners to negotiate more favorable premiums and ensures they select a policy that aligns with their specific needs and financial objectives.

Location, Property Value, and Personal Needs

The location of a property significantly impacts its insurance rates, as various factors such as crime rates, susceptibility to natural disasters, and neighborhood safety can influence premiums and coverage options.

Along with these geographical considerations, the valuation of the property is a critical determinant in assessing the necessary coverage for homeowners. For example, a residence located in an affluent area may necessitate higher coverage levels to reflect its increased value.

Personal needs are also of paramount importance; individuals residing in flood-prone regions often must consider additional endorsements, such as flood insurance, while others may seek specific protection against theft due to elevated local crime rates.

Ultimately, a comprehensive understanding of the interplay between location, property value, and individual requirements enables homeowners to select the most appropriate insurance options.

Common Homeowners Insurance Claims

Common homeowners insurance claims typically involve incidents such as property damage resulting from natural disasters, theft, and liability claims arising from injuries sustained on the property.

Understanding these prevalent claims enables homeowners to prepare effectively and select appropriate coverage limits tailored to their specific risks.

By being informed about the types of incidents that are most likely to occur, homeowners can navigate the claims process more efficiently and reduce their potential financial losses.

Types of Incidents Covered

Homeowners insurance typically encompasses a wide range of incidents, including theft, fire damage, and natural disasters. Understanding these various types of incidents is crucial for effective disaster recovery and claims processing.

Along with the more apparent events, such as storms and burglaries, homeowners insurance also covers lesser-known occurrences, including vandalism, water damage resulting from burst pipes, and liability claims arising from injuries that occur on the property.

For homeowners, being cognizant of the extent of their coverage can significantly alleviate stress during recovery periods. Maintaining a well-documented home inventory not only accelerates the claims process but also aids individuals in preserving their financial stability during challenging times.

This proactive approach ensures that essential belongings are accounted for, facilitating a smoother transition back to normalcy following any unfortunate incidents.

How to Save Money on Homeowners Insurance

Cost savings on homeowners insurance are crucial for many property owners and can be accomplished through several strategies, including:

- Reducing premiums

- Utilizing available discounts

- Comparing options within the insurance marketplace

Tips for Lowering Premiums

Homeowners can effectively reduce their homeowners insurance premiums by implementing risk mitigation strategies, such as installing security systems, maintaining their properties, and consulting with insurance agents for personalized recommendations.

By taking proactive measures to enhance safety and minimize risks, homeowners not only protect their investments but may also qualify for discounts from insurance providers.

Regularly assessing smoke detectors, securing doors and windows, and maintaining landscaping by trimming overgrown trees can substantially impact overall safety and risk levels.

Participation in local neighborhood watch programs or the integration of smart home technology can further demonstrate a commitment to security, potentially leading to lower insurance premiums.

Additionally, engaging with an insurance agent to review coverage options ensures that homeowners are adequately insured while maximizing savings through available discounts.

Frequently Asked Questions

What are the top reasons to get homeowners insurance?

1. Protection against financial loss: Homeowners insurance provides coverage for damages to your home and personal belongings, giving you financial protection in case of unexpected events such as natural disasters or theft.

2. Required by mortgage lenders: If you have a mortgage, your lender will likely require you to have homeowners insurance to protect their investment in your home.

3. Liability coverage: Homeowners insurance also includes liability coverage, which can protect you in case someone is injured on your property and decides to sue you.

What types of coverage does homeowners insurance offer?

1. Dwelling coverage: This covers damages to your home’s structure and attached structures such as a garage or deck.

2. Personal property coverage: This covers your personal belongings such as furniture, clothing, and electronics.

3. Additional living expenses coverage: If your home becomes uninhabitable due to a covered event, this coverage can help with the costs of temporary housing and other necessary expenses.

What are some common situations where homeowners insurance is helpful?

1. Natural disasters: Homeowners insurance can provide coverage for damages caused by hurricanes, tornadoes, wildfires, and other natural disasters.

2. Theft or vandalism: If your home is broken into or vandalized, homeowners insurance can cover the cost of repairs or replacements for stolen or damaged items.

3. Accidents on your property: If someone is injured on your property, homeowners insurance can cover their medical expenses, legal fees, and any damages awarded in a lawsuit.

Can homeowners insurance save me money in the long run?

Yes, homeowners insurance can save you money in the long run by providing financial protection in case of costly events such as natural disasters or lawsuits. Without insurance, you may have to pay for these expenses out of pocket, which can be financially devastating.

Are there any additional coverages I should consider adding to my homeowners insurance policy?

1. Flood insurance: Standard homeowners insurance policies do not cover damages caused by flooding, so if you live in a flood-prone area, it may be wise to add this coverage.

2. Umbrella liability insurance: This provides additional liability coverage above the limits of your homeowners insurance policy, which can be helpful for those with significant assets.

3. Home business insurance: If you run a business from your home, you may need additional coverage to protect your business assets and operations.