Tips to Save on Car Insurance Without Losing Coverage

Anúncios

Navigating the realm of car insurance can be a complex endeavor; however, a comprehensive understanding of its various components is essential for making informed decisions.

This overview will examine the different types of coverage available and the significance of each. It will address key factors that influence premiums, alongside effective strategies for saving money while ensuring adequate protection.

Furthermore, this document will provide guidance on how to compare quotes and highlight common mistakes to avoid. By equipping oneself with this knowledge, individuals can make smarter and more cost-effective choices regarding car insurance.

Understanding Car Insurance Coverage

A comprehensive understanding of car insurance coverage is essential for every driver, as it directly influences the financial protection afforded in the event of an accident or other incidents involving their vehicle.

Anúncios

Comprehensive coverage, which encompasses liability coverage, collision coverage, and uninsured motorist coverage, is crucial for safeguarding against a range of risks.

Furthermore, it is imperative to grasp the distinctions between various policy limits and the available coverage options to ensure sufficient protection. By familiarizing themselves with these terms and their implications, drivers can make informed decisions regarding their car insurance policies.

Types of Coverage and Their Importance

There are various types of coverage available in car insurance, each serving a distinct purpose and providing differing levels of financial protection in the event of an accident.

-

Liability coverage, for example, is essential as it protects drivers against claims made by others for bodily injury or property damage, helping with covering medical expenses and repair costs that could otherwise result in significant financial loss.

-

Moreover, collision coverage provides protection for the policyholder’s vehicle by covering repair costs resulting from accidents, irrespective of fault.

-

Conversely, comprehensive coverage protects against incidents that are not related to collisions, such as theft, vandalism, or natural disasters, ensuring that drivers can manage unforeseen events without incurring overwhelming financial burdens.

Collectively, these types of insurance play a vital role in overall risk management, allowing drivers to navigate the roads with confidence and a reliable safety net.

Factors That Affect Car Insurance Rates

Several factors can significantly influence car insurance rates, resulting in variations in premiums offered by different insurance providers and ultimately affecting a policyholder’s overall cost of coverage.

Key factors include the individual’s credit score, claims history, driving experience, and geographical location, all of which contribute to the risk assessment process.

Furthermore, the amount of mileage driven is also a critical consideration, as higher mileage may correlate with an increased likelihood of accidents, leading to potential rate adjustments.

Key Factors That Determine Premiums

Understanding the key factors that influence car insurance premiums is essential for individuals aiming to manage their insurance costs effectively. By recognizing how these elements interact, one can make informed decisions that may result in lower premiums.

For example, a clean driving record is among the most significant determinants, as insurers frequently reward safe drivers with discounts. Additionally, the number of miles driven annually can impact premiums; generally, less time spent on the road correlates with reduced risk.

Claims history is another critical factor, as a pattern of frequent claims may indicate to insurers that a driver is more likely to file additional claims in the future, which could lead to increased rates. Furthermore, an individual’s credit score can also affect premium costs, with higher scores typically resulting in lower expenses.

Engaging in proactive measures such as:

- Attending defensive driving courses,

- Reducing overall mileage,

- Maintaining a clean claims record, and

- Improving credit scores

can substantially contribute to obtaining more favorable premium rates.

Ways to Save on Car Insurance

Identifying methods to reduce car insurance costs is a primary concern for many drivers, as this enables them to decrease their expenses without sacrificing essential coverage for their vehicles.

Numerous strategies are available to assist individuals in achieving savings, including:

- Investigating available discounts

- Utilizing flexible payment plans

- Considering bundling options with other forms of insurance

Loyalty and family discounts can further augment savings, while multi-car policies offer considerable financial advantages for households with multiple vehicles.

Furthermore, specific discounts may be accessible to good students and military personnel, resulting in even lower premiums.

Tips for Lowering Premiums

Implementing effective strategies can lead to reduced car insurance premiums, thereby making it more affordable for drivers to maintain adequate coverage while managing their expenses.

By adopting several practical approaches, individuals can significantly lower their car insurance costs without sacrificing the quality of their coverage. For example, consistently maintaining a safe driving record is essential; this not only minimizes the risk of accidents but also allows many insurers to offer substantial discounts to safe drivers.

Additionally, leveraging telematics devices enables insurance companies to monitor driving behavior, which can result in further premium reductions for cautious drivers. Enrolling in recognized driver safety courses can enhance driving skills and demonstrate a commitment to safety, potentially yielding additional benefits.

Furthermore, utilizing accident forgiveness programs can prevent premium increases following a minor accident, allowing drivers to navigate their insurance costs more effectively.

How to Compare Car Insurance Quotes

Comparing car insurance quotes is a crucial step for consumers aiming to secure optimal coverage at competitive rates, facilitating knowledge-based decision making when selecting insurance providers.

By engaging in comparison shopping, individuals can effectively assess various quotes online and evaluate the coverage options available to them.

It is imperative to consider factors such as the claims process, policy limits, and any potential hidden fees during this comparison to ensure they are obtaining not only a favorable rate but also adequate coverage.

What to Look for in a Policy

When selecting a car insurance policy, it is imperative to evaluate multiple critical elements that can significantly influence both coverage and peace of mind.

It is essential to consider the various coverage options available, such as liability, collision, comprehensive, and uninsured motorist coverage, as each serves a distinct purpose in protecting the driver and their vehicle.

Understanding the factors that contribute to the calculation of premiums, including driving history and credit scores, can assist in securing the most favorable rate possible.

Deductibles also represent a crucial consideration; opting for a higher deductible may reduce monthly payments but could result in unexpected out-of-pocket expenses during a claim.

Furthermore, excellent customer service and efficient claims support are vital, providing reassurance in stressful situations.

Lastly, assessing the financial stability of insurance providers through ratings and reviews can help determine their ability to honor claims when needed.

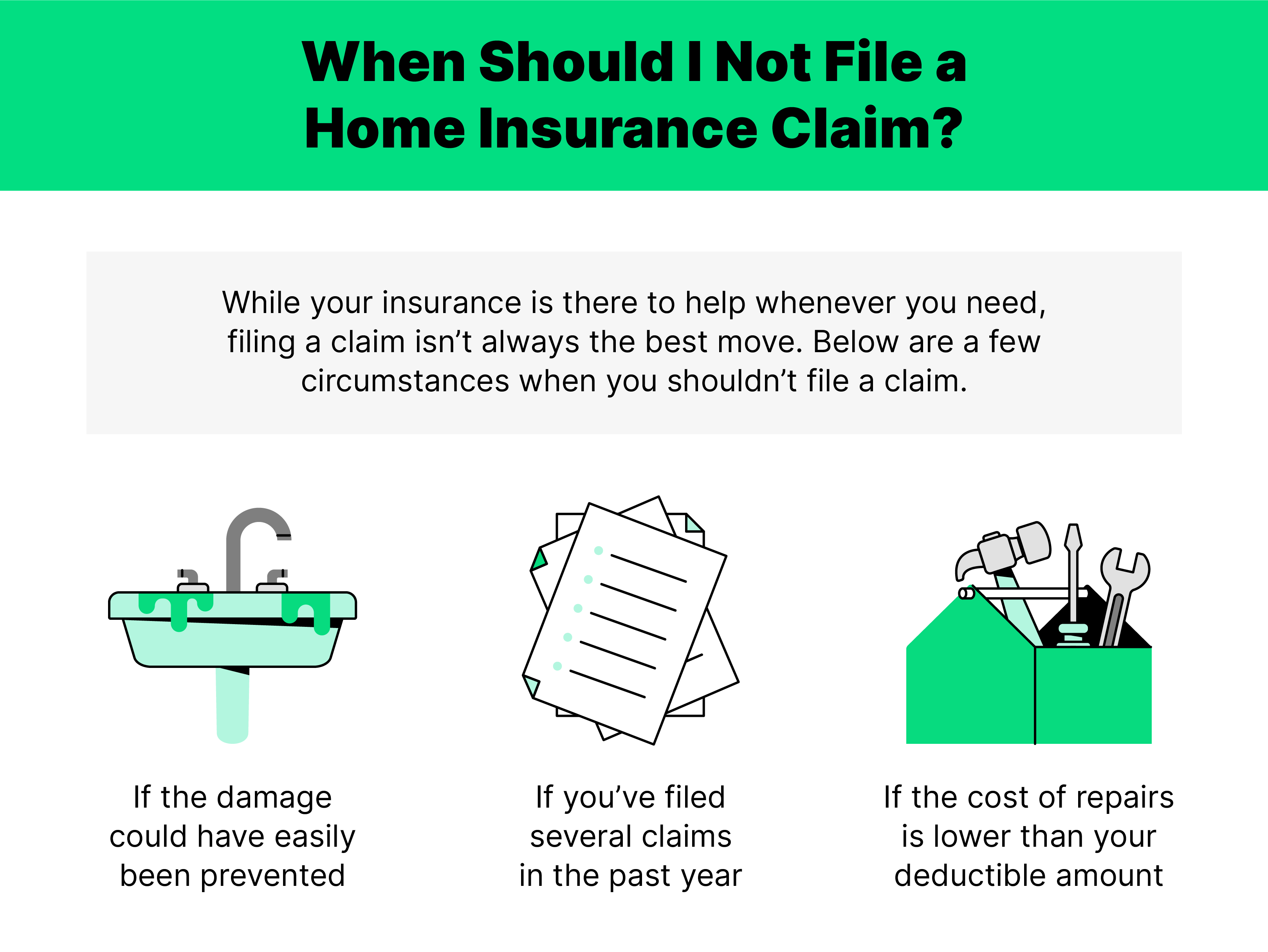

Common Mistakes to Avoid

Navigating the car insurance landscape presents various challenges, and making common mistakes can result in higher premiums or insufficient coverage.

Therefore, raising awareness about these potential pitfalls is essential.

Pitfalls That Can Lead to Higher Premiums

Several pitfalls can inadvertently result in higher car insurance premiums, making it essential for consumers to exercise diligence in managing their policies.

A poor claims history, for example, can lead to significant increases in costs, as insurers perceive frequent claims as indicative of higher risk. Additionally, a lack of a safe driving record can be detrimental, with incidents such as speeding tickets or accidents raising concerns for insurers.

Inadequate insurance shopping can further worsen the situation; failing to compare rates and coverage options may leave policyholders unaware of more favorable offers available in the market.

By remaining informed about these factors and routinely reviewing their coverage, drivers can enable themselves to make more informed decisions, ultimately helping with the reduction of their elevated premiums.

Frequently Asked Questions

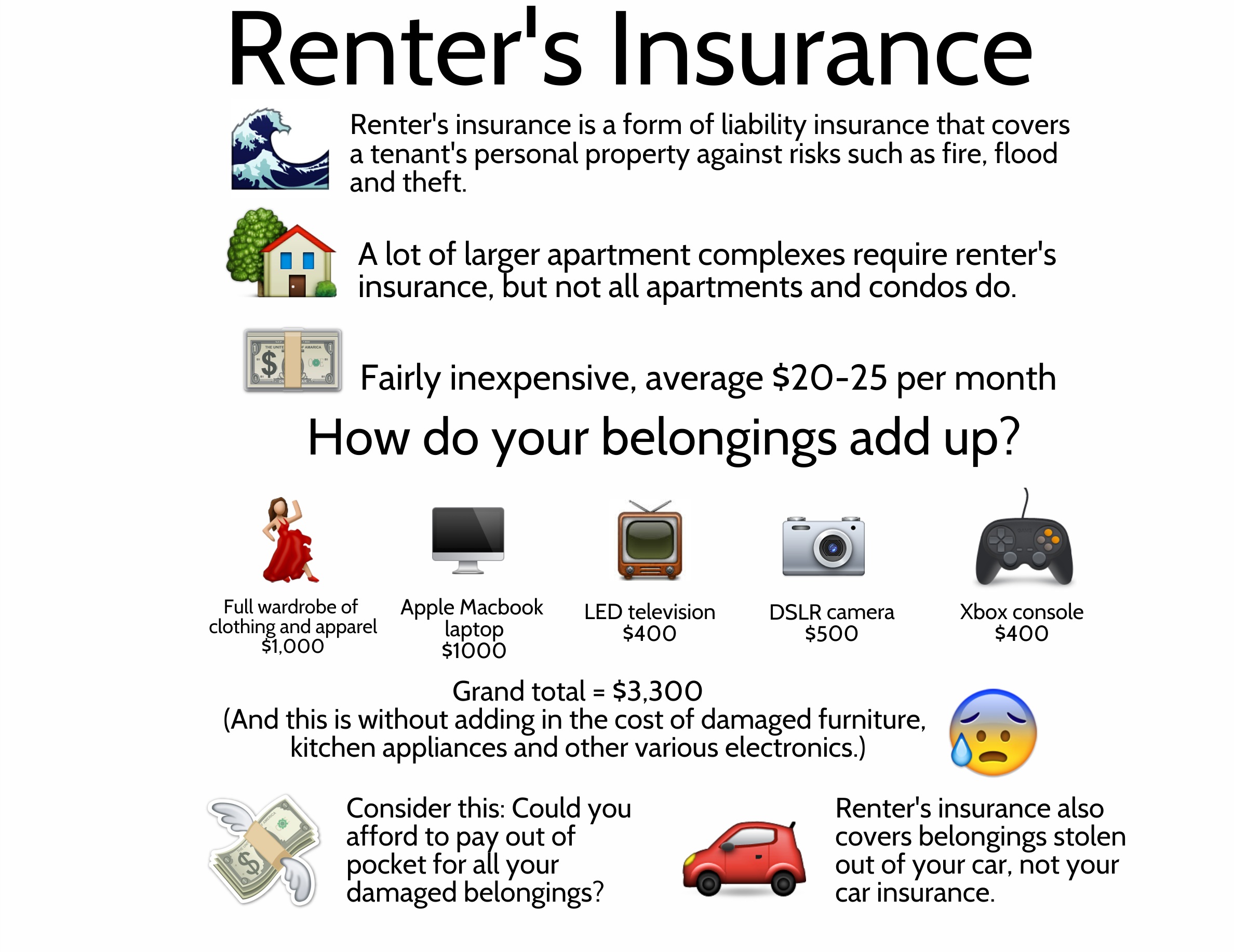

What are some simple tips to save on car insurance without losing coverage?

1. Compare quotes from different insurance companies to find the best rate for your coverage needs.

2. Consider increasing your deductible, which can lower your monthly premium.

3. Bundle your car insurance with other types of insurance, such as homeowner’s or renter’s insurance, for a multi-policy discount.

4. Take advantage of any available discounts, such as safe driver discounts or discounts for having multiple cars on one policy.

5. Review your coverage regularly and adjust it as needed, as you may no longer need certain types of coverage or may be able to decrease your coverage amounts.

6. Maintain a good credit score, as many insurance companies use credit history as a factor in determining rates.

Will I lose coverage if I take advantage of these money-saving tips?

No, as long as you are still meeting the minimum required coverage for your state, you will not lose coverage by implementing these tips.

Are there any other ways to save on car insurance without compromising coverage?

Yes, you can consider opting for usage-based insurance, where your rate is based on your actual driving habits, or installing safety devices in your car to qualify for additional discounts.

Will my coverage be affected if I switch insurance companies to save money?

No, as long as you have a seamless transition and do not have any lapses in coverage, your new insurance company will provide the same coverage as your previous one.

How often should I review my car insurance coverage and rates?

It’s recommended to review your coverage and rates at least once a year, or whenever there are any major changes in your driving habits or personal circumstances.

Is it possible to save on car insurance without sacrificing quality coverage?

Absolutely! By doing your research, comparing quotes, and taking advantage of available discounts, you can save on car insurance without losing the level of coverage you need. It’s important to strike a balance between saving money and ensuring adequate protection for yourself and your vehicle.