Step-by-Step Guide to Planning Your Retirement

Anúncios

Retirement planning is a critical process that fundamentally influences your future financial security and overall quality of life.

As individuals approach this significant phase, it becomes imperative to gain a comprehensive understanding of their current financial situation.

This guide will address the assessment of retirement needs, the creation of a customized plan, and an exploration of investment options designed to optimize savings.

Additionally, it will provide strategies for facilitating a smooth transition into retirement, along with tips for effective financial management in the post-retirement phase.

Anúncios

Prepare to take proactive steps towards realizing your retirement aspirations.

Why Retirement Planning is Important

Retirement planning is an essential process that enables individuals to achieve their financial objectives and sustain their desired lifestyle following their departure from the workforce.

This process involves evaluating current savings, investment strategies, and future needs, including healthcare expenses and income sources. By developing a comprehensive retirement plan, individuals can effectively prepare for potential lifestyle changes, account for inflation, and address unforeseen expenses, thereby securing their financial independence and readiness for retirement.

Furthermore, it is crucial to understand the implications of retirement accounts, such as 401(k)s and IRAs, in order to establish a robust retirement savings strategy.

Assessing Your Financial Situation

Assessing one’s financial situation is a critical initial step in the retirement planning process, as it offers a comprehensive understanding of current financial health and preparedness for retirement.

This assessment entails evaluating savings, analyzing the budget, and identifying various income sources, including Social Security and pension plans.

Additionally, conducting a risk assessment is vital, taking into account factors such as debt management and potential healthcare costs, which can significantly influence retirement funds and overall financial security.

Calculating Your Retirement Needs

Calculating retirement needs necessitates a thorough analysis of anticipated expenses, income sources, and desired lifestyle during retirement. This process can be effectively facilitated through the use of a retirement calculator.

By identifying essential lifestyle expenses and incorporating potential healthcare costs, individuals can develop a comprehensive retirement savings plan that ensures financial stability throughout their retirement years. Establishing an emergency fund serves as an important safety net, enabling the management of unexpected expenses while maintaining one’s lifestyle.

Utilizing a retirement calculator is integral to this process, as it aids in projecting the necessary savings based on various factors, including life expectancy and retirement age. Additionally, it is imperative to consider the impact of inflation on purchasing power over time; what appears sufficient today may not be adequate in the future.

A prudent financial planner should incorporate expected inflation rates when estimating future expenses to ensure that projections remain realistic.

By meticulously evaluating these variables, individuals can make informed decisions regarding contributions to retirement accounts, investment strategies, and the adjustment of savings goals, ultimately leading to a more secure and fulfilling retirement.

Evaluating Your Current Savings and Investments

Evaluating one’s current savings and investments is a crucial component of retirement planning, as it ensures that asset allocation is aligned with long-term financial objectives. This process includes a thorough review of retirement accounts, such as 401(k)s and IRAs, along with an analysis of investment options to ascertain their capacity to meet retirement income requirements. By gaining a comprehensive understanding of the performance of existing savings and investments, individuals can make informed adjustments to enhance their retirement strategy.

To effectively evaluate these strategies, the initial step is to conduct a comprehensive assessment of one’s overall financial situation, including income, expenses, and any outstanding debts. Following this, it is essential to consider risk tolerance and investment horizon, as these factors will influence asset allocation decisions, guiding the distribution of investments across various asset classes such as stocks, bonds, and real estate.

Moreover, retirement accounts are instrumental in maximizing tax advantages and facilitating compound growth over time, significantly affecting the total amount available during retirement. Regularly revisiting and rebalancing the investment portfolio is vital to ensure alignment with evolving financial objectives.

Creating a Retirement Plan

Creating a retirement plan is crucial for achieving retirement goals and ensuring financial security in later years.

This process commences with the establishment of clear objectives, including the desired retirement age and lifestyle, followed by the development of a comprehensive budgeting strategy that aligns with these goals.

Consulting with a financial advisor can offer valuable insights and guidance in formulating a personalized retirement savings plan, enabling individuals to effectively navigate the complexities of investment strategies and account management.

Setting Goals and Priorities

Establishing clear retirement goals and priorities is essential for developing an effective retirement plan that aligns with an individual’s vision for the future. These objectives may encompass various factors, such as the desired retirement lifestyle, travel aspirations, financial independence, and considerations related to legacy planning for one’s family.

A well-defined strategy enables individuals to visualize their post-retirement life, thereby give the power toing them to allocate resources judiciously. For example, an individual with aspirations for extensive travel may prioritize saving for a travel fund, while another may focus on ensuring they have a comfortable home that meets their needs.

The importance of understanding healthcare expenses cannot be overstated, as planning for potential medical costs can significantly impact overall savings. By dedicating time to clarify these retirement objectives, individuals can enhance their ability to create a customized roadmap that addresses both immediate needs and fosters long-term security and peace of mind.

Developing a Budget and Savings Strategy

Developing a robust budgeting and savings strategy is essential for achieving retirement goals and ensuring financial stability. This process entails a thorough assessment of current cash flow management, identifying potential areas for savings, and formulating a retirement savings plan that encompasses contributions to retirement accounts, emergency funds, and various investment options.

By adopting a disciplined approach to budgeting, individuals can effectively prepare for future expenses and attain their financial objectives.

A comprehensive understanding of budgeting tools, such as applications that monitor spending or online calculators that assist in projecting future savings, can significantly enhance one’s strategy. Implementing the ’50/30/20′ rule—allocating 50% of income to necessities, 30% to discretionary spending, and 20% to savings—can provide a straightforward yet effective framework for financial management.

Regularly reviewing and adjusting the budget in response to any changes in income or expenses is crucial for maintaining control over financial matters. Additionally, exploring avenues to automate savings and considering investment diversification will further strengthen the path toward achieving long-term financial success.

Investing for Retirement

Investing for retirement is a crucial component in establishing a sufficient nest egg to support one’s desired lifestyle after ceasing employment. This process entails the selection of suitable investment strategies, a comprehensive understanding of various retirement accounts, and the decision-making between fixed and variable income options to effectively diversify the investment portfolio.

By actively managing investment strategies and consistently assessing asset allocation, individuals can optimize potential returns while minimizing risks as they near retirement.

Understanding Different Investment Options

Understanding the various investment options is a fundamental aspect of effective retirement planning, as it enables the creation of a diversified portfolio that aligns with individual financial goals. Common investment alternatives include stocks, bonds, mutual funds, and annuities, each presenting distinct benefits and associated risks.

By carefully evaluating these options and considering one’s risk tolerance, individuals can make informed decisions that support their overall retirement strategies and objectives.

Stocks offer long-term growth potential; however, their higher volatility may make them more suitable for individuals with a longer investment horizon. In contrast, bonds are typically regarded as safer investments, providing steady income and stability, which may be particularly appealing to those nearing retirement.

Mutual funds facilitate diversification by combining multiple investments, while annuities can offer guaranteed income over time, thereby ensuring financial security during retirement.

By comprehending the characteristics of each investment option and how they correspond to different financial profiles, individuals can develop a comprehensive retirement plan that effectively balances risk and reward.

Maximizing Your Retirement Savings

Maximizing retirement savings is essential to ensure adequate funds are available to support an individual’s desired retirement lifestyle. This can be accomplished by fully utilizing employer matching contributions, adhering to contribution limits in retirement accounts, and exploring various investment strategies that offer tax advantages.

A thorough understanding of the tax implications associated with contributions can further enhance overall savings potential and assist in achieving financial goals.

Regularly reviewing and adjusting the savings plan in response to changing financial circumstances and life stages is also crucial. For instance, individuals should consider increasing their contributions upon receiving raises or bonuses.

Utilizing tax-advantaged accounts such as Roth IRAs or 401(k)s can provide substantial benefits, including the potential for tax-free growth on investments.

Consulting with a financial advisor can provide personalized strategies that align with individual retirement objectives, guiding individuals in optimizing asset allocation and ensuring that their investments generate maximum returns over time.

Preparing for Retirement

Preparing for retirement involves several critical factors that facilitate a seamless transition from the workforce to a rewarding retirement lifestyle.

This process includes careful planning for healthcare needs, selecting an appropriate retirement community, and implementing necessary lifestyle adjustments to adapt to this new stage of life.

By proactively addressing these components, individuals can effectively navigate the complexities associated with retirement and improve their overall quality of life in their later years.

Transitioning to Retirement

Transitioning into retirement entails significant lifestyle changes that can impact both emotional well-being and financial preparedness for this new phase of life. It is essential to address the emotional aspects associated with leaving the workforce and to develop a comprehensive plan that meets one’s financial requirements.

As individuals enter this new chapter, they frequently encounter a blend of excitement and apprehension related to the changes in their daily lives. Many individuals may experience feelings of loss associated with their professional identity, which can be emotionally challenging.

To mitigate these feelings, engaging in meaningful activities such as volunteering or pursuing personal interests can provide a renewed sense of purpose and foster community connections.

From a financial perspective, it is advisable to evaluate current expenses and adjust budgets accordingly to maintain a comfortable lifestyle. Consulting with financial planners who specialize in retirement can also alleviate concerns regarding the management of savings and investments.

By taking proactive measures, the transition into retirement can transform into a rewarding and enriching experience.

Managing Your Finances During Retirement

Managing finances during retirement is crucial to ensure that retirement income is sustainable throughout one’s lifetime and is in alignment with lifestyle expenses. This process involves developing a withdrawal strategy that effectively balances various income sources, such as Social Security, pensions, and investment returns, while also accounting for potential long-term care costs.

By consistently monitoring and adjusting the financial plan, individuals can maintain financial stability and achieve peace of mind throughout their retirement years.

Effective financial management in retirement often necessitates strategic decisions regarding the timing of withdrawals from different accounts. For example, delaying Social Security benefits can be advantageous, as it maximizes monthly payments in the future.

Additionally, integrating various income sources, such as annuities or rental income, can contribute to a consistent cash flow. It is prudent to consider tax implications when formulating a withdrawal strategy, ensuring that the tax burden is minimized while taking full advantage of lower tax brackets.

Regularly reviewing one’s portfolio and spending habits allows for necessary adjustments that reflect both market changes and personal financial needs, thus promoting resilience in the financial journey.

Frequently Asked Questions

What is a step-by-step guide to planning your retirement?

A step-by-step guide to planning your retirement is a comprehensive set of instructions that will help you create a personalized plan for your retirement. It will cover all aspects of retirement planning, such as setting financial goals, creating a budget, and making decisions about retirement investments.

Why is it important to have a step-by-step guide for retirement planning?

Having a step-by-step guide for retirement planning is important because it helps you stay organized and on track towards your retirement goals. It also ensures that you don’t miss any crucial steps in the planning process.

What are the benefits of following a step-by-step guide to planning your retirement?

Following a step-by-step guide to planning your retirement can help you make informed decisions about your financial future. It can also give you a clear understanding of your retirement goals and how to achieve them.

What are the key elements of a step-by-step guide to planning your retirement?

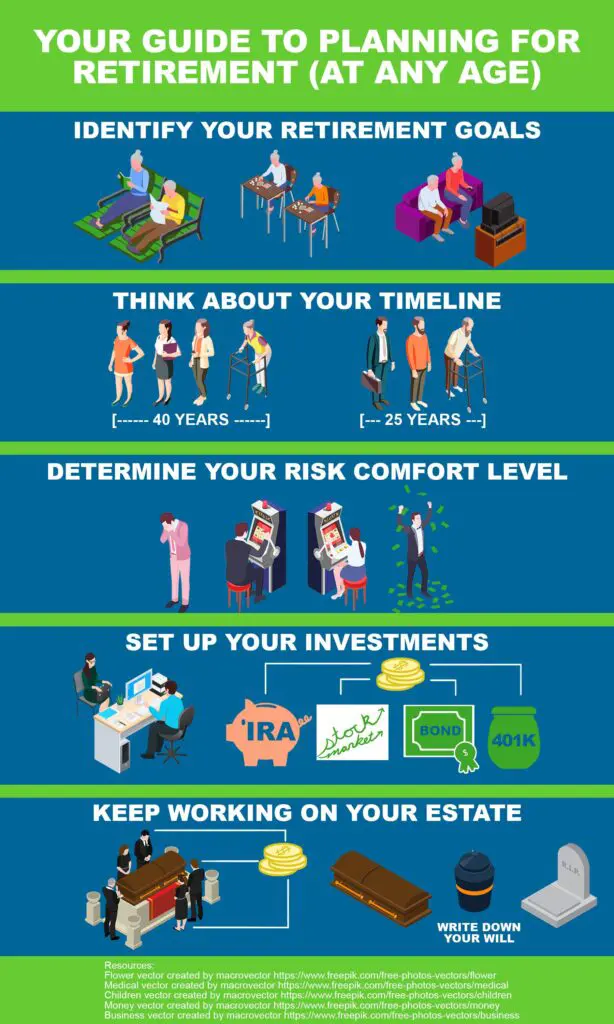

The key elements of a step-by-step guide to planning your retirement include identifying your retirement goals, assessing your current financial situation, creating a budget, choosing retirement investments, and regularly reviewing and adjusting your plan.

How can I use the reference data to create a personalized step-by-step guide to planning my retirement?

You can use the reference data provided to guide you in creating a personalized step-by-step guide to planning your retirement. Use the information to set realistic goals and make informed decisions about your finances.

Do I need to follow the step-by-step guide exactly or can I make adjustments?

The step-by-step guide is meant to be a general framework for retirement planning. You can make adjustments and tailor it to fit your individual needs and goals. However, it is important to make sure that your plan is still realistic and achievable.