How to Negotiate Better Rates with Your Insurance Provider

Anúncios

Navigating the realm of insurance can be a complex endeavor, particularly when it involves comprehending your coverage and negotiating more favorable rates.

Whether you seek to reduce your premium or enhance your benefits, effective communication with your insurance provider is essential.

This guide outlines the fundamental steps for reviewing your policy, gathering the necessary documentation, and employing negotiation techniques that can yield significant results.

Additionally, it addresses strategies for managing pushback and fostering a positive relationship with your provider for future interactions. Prepare to take control of your insurance experience.

Anúncios

Understanding Your Insurance Coverage

Understanding insurance coverage is essential for ensuring that individuals possess the appropriate protection tailored to their specific needs. This encompasses various elements, including policy terms, premiums, coverage limits, and the claims process.

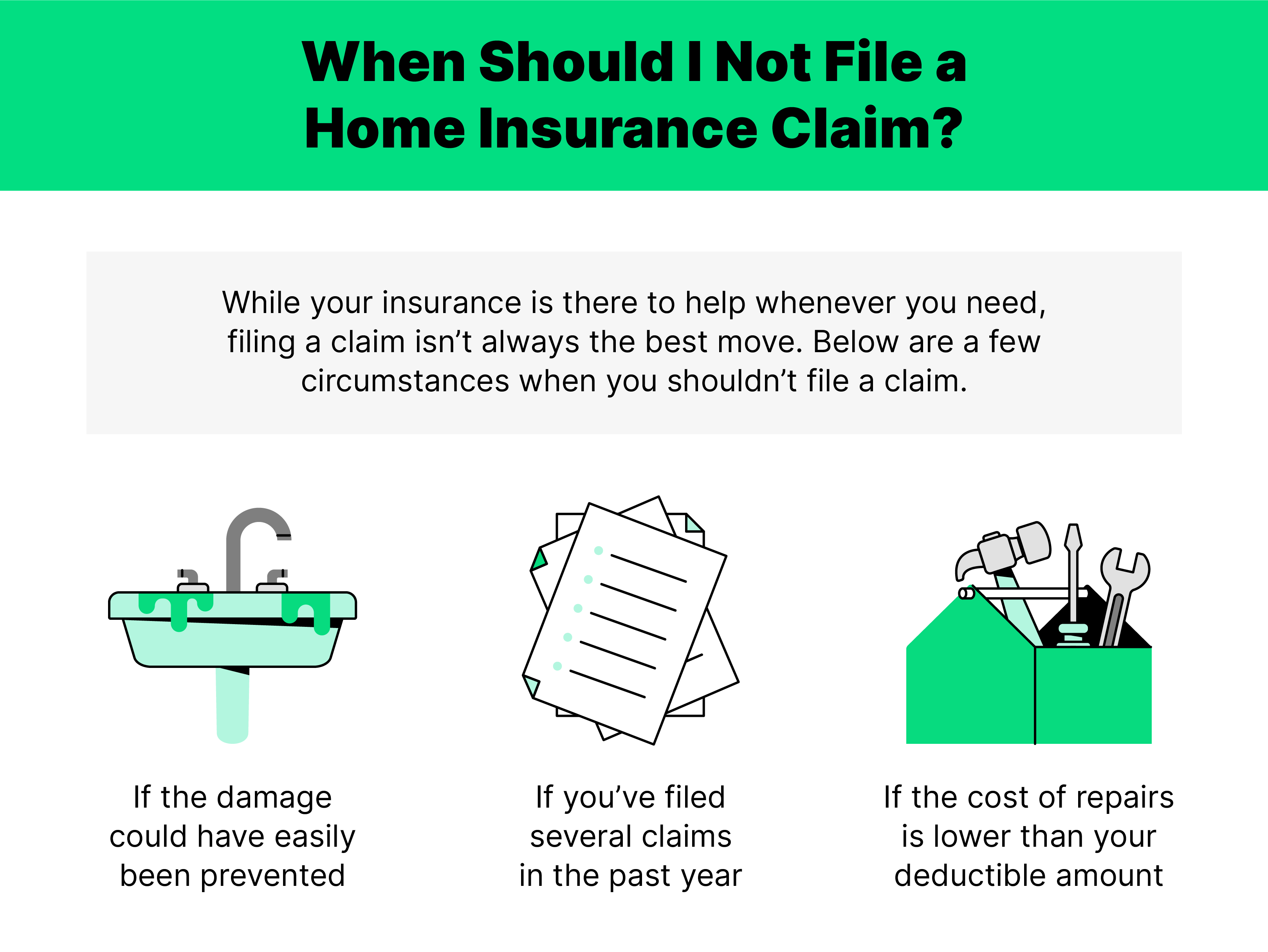

By thoroughly examining the details of one’s insurance policy, individuals can identify the benefits to which they are entitled, the deductibles they are responsible for, and any out-of-pocket costs they may face. This knowledge enables knowledge-based decision making regarding financial stability and risk assessment strategies.

Additionally, a comprehensive understanding of the intricacies of one’s coverage can enhance negotiations with the insurance provider, potentially leading to improved rates and discounts during the renewal period.

Reviewing Your Policy and Benefits

Regularly reviewing one’s insurance policy and benefits is essential to ensure optimal coverage tailored to individual needs. This practice allows for a comprehensive comparison of current policy quotes with those from other insurance providers.

By taking the time to assess various coverage options, individuals can determine whether adjustments are necessary to align their policies with life changes or emerging risks. Customer feedback is pivotal in this evaluation process, as insights and experiences can reveal gaps in coverage that may not have been previously identified.

Navigating the insurance landscape is facilitated by leveraging policy comparisons, enabling the identification of not only competitive rates but also superior service and claims handling.

Ultimately, adopting a proactive approach in this manner can yield financial savings and provide peace of mind, ensuring that individuals are adequately protected against unforeseen circumstances.

Preparing for Negotiations

Preparing for insurance negotiations is an essential step in obtaining improved rates and coverage. This process necessitates comprehensive market research and competitor analysis to get a good idea of the available options.

Additionally, it is important to refine negotiation tactics and communication skills. By formulating effective negotiation strategies and identifying potential leverage, individuals can engage with their insurance providers in a confident and assertive manner, ensuring that their needs and financial objectives are appropriately represented during discussions regarding policy terms and possible discounts.

Gathering Information and Documentation

Gathering the appropriate information and documentation is essential for successful insurance negotiations, as it enables the presentation of a compelling case for rate adjustments and policy enhancements based on claims history and an understanding of policyholder rights.

To effectively navigate these discussions, it is crucial to possess comprehensive documentation, including previous claims records, assessment criteria, and detailed notes regarding past interactions with customer service representatives.

Being organized not only streamlines the negotiation process but also reflects a proactive approach that can significantly improve communication. This preparation allows individuals to articulate their needs clearly and confidently, ensuring that their concerns are addressed in a timely and appropriate manner.

When negotiating with insurance companies, a thorough understanding of the nuances of one’s coverage, coupled with all relevant documents, can lead to more favorable outcomes and ensure that the negotiation process is as efficient as possible.

Negotiating Techniques

In the context of negotiating with an insurance provider, the application of effective negotiation techniques can greatly increase the probability of achieving favorable outcomes.

This process involves a blend of assertiveness, persuasive strategies, and a comprehensive understanding of negotiation psychology. By mastering these competencies, individuals can articulate their needs clearly and effectively, ensuring that their viewpoints are understood and respected throughout discussions regarding policy terms and potential discounts.

Tips for Effective Communication

Mastering effective communication is essential when engaging in negotiations with your insurance provider. This process requires active listening and a clear articulation of your needs and concerns, which ultimately fosters customer advocacy and strengthens relationships.

By implementing effective communication strategies, you can ensure that your discussions are productive and focused on achieving satisfactory outcomes concerning your coverage and premiums.

To enhance your negotiation efforts, it is advisable to prepare a list of key points that you wish to address during the conversation. This approach will help you remain organized and prevent deviating from the main topics.

Demonstrating your commitment to understanding the perspective of the other party is crucial. Maintaining eye contact and using affirming nods can create a more collaborative atmosphere. Additionally, do not hesitate to pose open-ended questions that encourage dialogue and clarify any uncertainties.

This practice not only uncovers valuable insights but also conveys respect for their input, thereby facilitating a more productive negotiation process.

Strategies for Negotiating Rates

Implementing effective rate negotiation strategies is essential for securing improved premiums and discounts from insurance providers. A comprehensive understanding of market trends, coupled with consideration of bundled coverage options, can significantly strengthen one’s negotiating position.

By leveraging customer loyalty and aligning negotiations with financial objectives, one can achieve favorable outcomes in discussions regarding rate adjustments.

Conducting thorough market research enables individuals to assess prevailing rates and available options, thereby identifying the most competitive offers to utilize as leverage. Exploring bundled coverage not only streamlines management but may also unlock discounts that are not available with individual policies.

Highlighting a history of timely payments and long-term commitment serves as a compelling reminder to insurance providers of the customer’s reliability. During negotiations, it is crucial to articulate specific financial goals, whether related to saving for future investments or minimizing monthly expenditures. This clarity assists providers in recognizing the mutual benefits of accommodating such requests.

Handling Rejection and Counteroffers

Managing rejection and counteroffers during insurance negotiations can be a complex process; however, implementing strategies based on negotiation psychology can assist in preserving trust and fostering the development of ongoing relationships with insurance providers.

By comprehending the underlying reasons for a counteroffer and responding in a suitable manner, individuals can not only improve their negotiation results but also cultivate a collaborative environment for future discussions.

Dealing with Pushback and Alternative Offers

Addressing pushback from an insurance provider necessitates a strategic approach, as this often involves evaluating alternative offers and comprehensively understanding the claims process to effectively counter objections while ensuring customer satisfaction.

Navigating these challenges requires a thorough assessment of potential fallback options, enableing individuals to present compelling arguments.

One effective strategy includes proactive communication, which fosters transparency regarding needs and expectations. By clearly articulating their circumstances, negotiators can align with the provider’s objectives, facilitating the identification of common ground.

It is essential to prioritize the maintenance of quality service throughout any negotiation process. This approach not only alleviates frustrations but also reinforces a commitment to customer satisfaction, increasing the likelihood that providers will consider viable solutions that meet the needs of both parties.

Finalizing Negotiations

Finalizing negotiations with your insurance provider is a critical step that entails reaching an agreement on terms and ensuring that all modifications are thoroughly documented to prevent misunderstandings in the future.

This process ultimately facilitates the improvement of the policy to better align with your needs. By maintaining clear communication and utilizing customer support throughout this process, one can achieve a mutually beneficial arrangement that enhances insurance coverage.

Agreeing on Terms and Documenting Changes

Agreeing on terms and documenting changes is essential for ensuring clarity and mutual understanding in insurance negotiations. This process involves a thorough review of insurance clauses and policy limits to confirm that all parties are aligned on the agreed-upon modifications.

This crucial step protects both the insurer and the insured by minimizing the risk of disputes when claims arise. Proper documentation serves as a safeguard, ensuring that any alterations to the policy are clearly outlined and comprehended by all involved.

By establishing written records of these changes, parties can refer back to succinct guidelines, which significantly aids in expediting the claims process.

When the time comes to file a claim, having documented terms can also prevent misunderstandings, ensuring that all parties have a clear understanding of coverage specifics and limits, ultimately leading to a more efficient resolution.

Maintaining Good Relations with Your Insurance Provider

Maintaining positive relationships with your insurance provider is crucial for fostering long-term partnerships that can result in more favorable rates and enhanced service quality.

This process relies on effective relationship building and a proactive approach to communication and support.

By prioritizing customer loyalty and trust, individuals and organizations can navigate future negotiations with confidence and mutual respect.

Building a Positive Relationship for Future Negotiations

Establishing a positive relationship with one’s insurance provider represents a long-term investment that enhances the capacity to negotiate effectively in the future. Trust and customer satisfaction are critical components of this dynamic.

When individuals develop a rapport with their insurers, they foster an environment conducive to open dialogue. This level of communication facilitates a better understanding of policy details, claims processes, and potential coverage options, significantly influencing future negotiations.

As rapport strengthens, the likelihood that the provider will prioritize the client’s needs also increases. In this context, effective communication skills become essential assets, enableing clients to navigate complex discussions with greater confidence.

When both parties establish mutual trust, the outcomes of negotiations typically become more favorable, leading to mutually beneficial agreements and enhanced overall satisfaction.

Frequently Asked Questions

1. How can I negotiate better rates with my insurance provider?

The first step to negotiating better rates with your insurance provider is to do your research. Make sure you understand your coverage and how it compares to similar plans offered by other providers. This will give you leverage in negotiations.

2. Is it possible to negotiate lower rates with my current insurance provider?

Yes, it is possible to negotiate lower rates with your current insurance provider. This is especially true if you have been a loyal and long-standing customer, and can provide evidence of better rates offered by competitors.

3. What are some tactics that can be used to negotiate better rates with insurance providers?

There are a few tactics that can be used to negotiate better rates with insurance providers. These include being prepared with research, being persistent and confident, and being willing to compromise or switch providers if necessary.

4. How can good communication help in negotiating better rates with insurance providers?

Good communication is essential in negotiating better rates with insurance providers. It is important to clearly explain your needs and concerns, and to actively listen to the responses of your provider. This can help to build a relationship and find common ground for negotiations.

5. Is it ever too late to try and negotiate better rates with my insurance provider?

No, it is never too late to try and negotiate better rates with your insurance provider. Even if you have already signed a contract, you can still approach your provider and discuss potential options for better rates or coverage.

6. Are there any potential risks involved in negotiating better rates with insurance providers?

There are some potential risks involved in negotiating better rates with insurance providers. These may include facing resistance or pushback from your provider, or potentially damaging the relationship if negotiations do not go as planned. It is important to weigh these risks against the potential benefits before entering into negotiations.