How to File an Insurance Claim Step-by-Step

Anúncios

Filing an insurance claim can often be a daunting experience, particularly when one is faced with the stress associated with damage or loss.

A comprehensive understanding of the claims process is essential to ensure that you receive the compensation you rightfully deserve.

This guide aims to provide a detailed walk-through of each step involved, beginning with a definition of what an insurance claim is, alongside the various types available. It will also cover the preparation of necessary documentation, the process of filing your claim, and effective communication strategies with your insurance company.

Additionally, this guide will offer valuable tips to help avoid common pitfalls, thereby facilitating a smoother claims experience.

Anúncios

Understanding Insurance Claims

Understanding insurance claims is essential for policyholders who must navigate the complexities of filing a claim following a loss, whether it pertains to property damage, personal injury, or vehicle accidents.

The process of insurance claims involves a structured approach that necessitates a comprehensive understanding of the specific terms and conditions outlined in an insurance policy, along with the appropriate documentation required to substantiate a claim.

Familiarity with the claims process is critical for ensuring a timely and effective submission, which is vital for obtaining the appropriate compensation from the insurance provider.

What is an Insurance Claim?

An insurance claim is a formal request submitted by a policyholder to an insurance company, seeking compensation for a loss that is covered under the terms of their insurance policy, such as property damage or personal injury. This request typically necessitates the submission of essential documentation, including a proof of loss statement, claim forms, and, depending on the circumstances, an accident report. An insurance adjuster will review these materials to assess the validity of the claim and determine the appropriate compensation amount.

The significance of an insurance claim lies in its function as a financial safeguard for individuals and businesses, enabling them to recover from unforeseen events. When a policyholder files a claim, it initiates a meticulous process that involves thorough documentation and assessment. The insurance adjuster plays an essential role in this process by investigating the circumstances surrounding the loss and evaluating the evidence submitted. Their findings not only influence the approval decision of the claim but also impact the settlement amount.

Consequently, it is imperative for policyholders to ensure that the documentation provided is accurate, comprehensive, and reflective of the true extent of the loss. Any discrepancies in the submitted materials could lead to delays in the claims process or potential denial of the claim.

Types of Insurance Claims

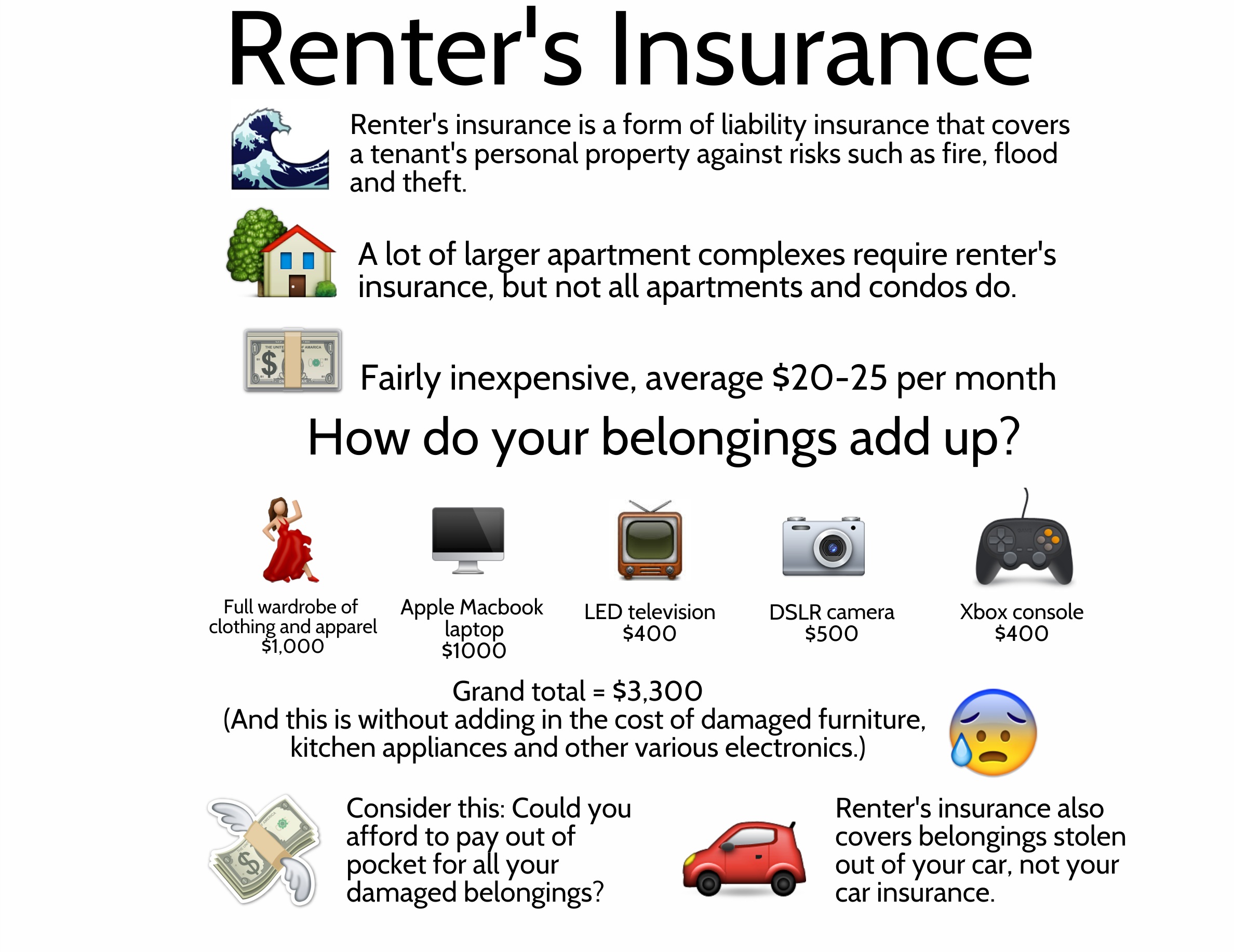

There are various types of insurance claims that policyholders may encounter, depending on the nature of their insurance coverage, including auto insurance, home insurance, and health insurance.

Comprehending the distinctions between these claims is essential for individuals as they navigate their insurance needs.

For example, auto insurance claims may involve property damage resulting from a collision or medical expenses due to injuries sustained in an accident. Conversely, home insurance claims typically address damages resulting from natural disasters or theft, enabling homeowners to recover financially.

Health insurance claims focus on medical payments, ensuring that individuals can access necessary treatments without incurring substantial costs. Third-party claims arise when policyholders seek compensation from another party’s insurance, often complicating the claims process.

Additionally, uninsured motorist situations present unique challenges, as drivers must depend on their own policies when involved in incidents with those lacking coverage.

A comprehensive understanding of these various claims enables policyholders to manage risks effectively.

Preparing to File a Claim

Preparing to file a claim is a crucial step that necessitates the collection and organization of the required documentation to substantiate your case. It is imperative to ensure compliance with the insurance provider’s requirements and the established claims process.

This preparation typically involves compiling a loss report, gathering pertinent accident details, and meticulously tracking your claim number, which is essential for facilitating effective communication with your insurance company.

Gathering Necessary Information

Gathering the necessary information is a fundamental aspect of the claims preparation process, as it entails collecting all pertinent data that will support an insurance claim. This includes claim forms, accident reports, medical records, and receipts for any incurred expenses. It is essential to ensure that complete and accurate documentation is obtained to prevent delays and potential claim denials during the review process.

For instance, in the context of a car accident claim, acquiring a copy of the police report is critical, as it provides an official account of the incident and aids in verifying the facts. Additionally, collecting witness statements and photographs of the accident scene can substantiate one’s version of events.

In the case of health-related claims, securing medical records that detail treatments and consultations is vital, as it establishes a clear connection between the injury or incident and the medical expenses incurred.

Maintaining organized records not only streamlines the claims process but also enhances the credibility of the claim, thereby reinforcing its validity in the eyes of the insurance adjuster. Consequently, being meticulous in documentation efforts can significantly influence the outcome of the claim.

Documenting Damage or Loss

Documenting damage or loss is a critical component of the insurance claim process, as it provides the necessary proof of loss to substantiate the claim and ensure appropriate compensation is received. This documentation should encompass photographs of the damage, witness statements, and any other supporting evidence that assists the insurance adjuster in effectively assessing the situation.

Comprehensive documentation serves not only to validate the incident but also to expedite the claims process. When collecting evidence, it is advisable to capture clear and detailed photographs from multiple angles and, when possible, to include time-stamped images to establish a timeline.

Witness statements can significantly enhance the credibility of a claim; therefore, it is essential to obtain their contact information and encourage them to provide thorough accounts. Additionally, maintaining organized records of all correspondence and notices will facilitate the presentation of a cohesive narrative.

This meticulous approach not only substantiates the claim but also contributes to a more streamlined interaction with the insurance provider.

Filing the Claim

Filing a claim is a critical step in the claims process, during which policyholders formally submit their claim to the insurance company. This requires the meticulous completion of claim forms and strict adherence to the specific guidelines detailed in their insurance policy.

The process may include electronic submission options that facilitate the filing, thereby ensuring a timely review by the claims department and a more efficient update regarding the status of the claim.

Step-by-Step Process

The step-by-step process for filing a claim is structured to assist policyholders in navigating the complexities of claim submission efficiently, beginning with the initial reporting of the loss and concluding with the final review conducted by an insurance adjuster. Each step in this process is vital, as it contributes to the overall timeline of the claim and influences the outcome of the compensation awarded.

- Policyholders should commence by gathering the necessary documentation and evidence of the loss, as this information is critical for the initial assessment.

- Once the claim has been filed, an insurance adjuster will reach out to review the details and may visit the site of the loss.

- It is essential to maintain open lines of communication, as timely follow-up regarding the claim status can help alleviate any uncertainties.

- Understanding the role of the adjuster and actively engaging with them will assist in clarifying expectations and promoting a smoother resolution.

- Throughout the process, policyholders should remain informed about the timeline and any additional information that may be required to ensure a fair evaluation of their claim.

Working with Your Insurance Company

Effectively collaborating with your insurance company is crucial for a seamless claims process, as it enhances communication between policyholders and insurance representatives, including customer service and claims department personnel.

This partnership is particularly important during the claim negotiation phase, where transparent communication can result in more favorable claim resolution outcomes and ensure that policyholders receive appropriate compensation.

Communicating and Negotiating

Effective communication and negotiation with your insurance company play a significant role in the claims handling process, particularly when addressing potential claim denials or navigating the appeal process. By being well-prepared and articulating your case with clarity, you can advocate for your rights and enhance the likelihood of achieving a favorable outcome.

Establishing a respectful rapport with insurance representatives is essential, as it sets a positive tone for constructive discussions. When engaging in dialogue, it is prudent to present all relevant documentation and details comprehensively, enabling the representative to fully understand the situation.

Employing negotiation strategies, such as maintaining composure, can also be beneficial; emotions often have the potential to derail the process. If there is a claim denial, it is advisable to thoroughly review the denial letter to grasp the reasoning behind the decision. Engaging in a follow-up conversation can provide further clarity and may reopen discussions.

If a claim continues to be denied, it is advisable to formally appeal the decision by submitting additional evidence along with a well-reasoned argument that supports the validity of the claim.

Receiving Compensation

The primary objective of the insurance claim process is to obtain compensation, culminating in a benefit payout that assists in alleviating the financial losses incurred as a result of the incident.

It is essential for policyholders to comprehend the complexities of settlement offers and the claim resolution process in order to ensure they receive the compensation to which they are entitled in a timely manner.

What to Expect and How to Handle Delays

Understanding the claims process, including potential delays, is essential for policyholders to navigate their interactions with the claims department more effectively, ultimately enhancing customer satisfaction.

Awareness of common causes of claim delays, such as incomplete documentation or the need for additional investigations, enables policyholders to take proactive measures.

For instance, delays may arise from the necessity of further assessments or investigations, which can be time-consuming. To manage expectations appropriately, it is crucial for individuals to maintain regular communication with the claims department.

This practice allows them to receive timely updates on their claim status, thereby alleviating frustrations associated with uncertainty.

Ensuring that all required documents are submitted completely and accurately can significantly expedite the review process. Open and consistent communication not only fosters a positive rapport but also equips individuals with the knowledge to address any issues as they arise, promoting a smoother claims experience overall.

Tips for a Smooth Claims Process

Implementing best practices for a seamless claims process can greatly enhance the experience of claimants, ensuring the avoidance of common errors that may delay compensation.

Essential strategies include:

- Meticulous attention to claim documentation,

- A thorough understanding of the details of one’s insurance policy coverage,

- Strict adherence to timely filing requirements.

Common Mistakes to Avoid

Being cognizant of common mistakes to avoid during the claims process can significantly save policyholders time and alleviate frustration, thereby ensuring that their claims are managed efficiently and effectively.

Errors such as failing to provide complete documentation, misrepresenting facts, or engaging in insurance fraud can lead to serious consequences, including claim denial or potential legal issues.

One prevalent error is the lack of comprehensive documentation; claimants frequently underestimate the importance of maintaining a well-organized file that includes receipts, photographs of damages, and records of communication with the insurer.

Providing incomplete or misleading information can raise concerns, potentially prompting investigations that may delay claims and cause unnecessary stress. It is essential for individuals to be honest and precise in their statements to avoid the significant implications of insurance fraud, which can not only jeopardize a claim but also result in severe legal consequences.

By taking these precautionary measures, policyholders can navigate the claims process with increased confidence and peace of mind.

Frequently Asked Questions

What is the first step in filing an insurance claim?

The first step is to gather all necessary information and documents related to your insurance policy and the incident that you are filing a claim for.

How do I know if I am eligible to file an insurance claim?

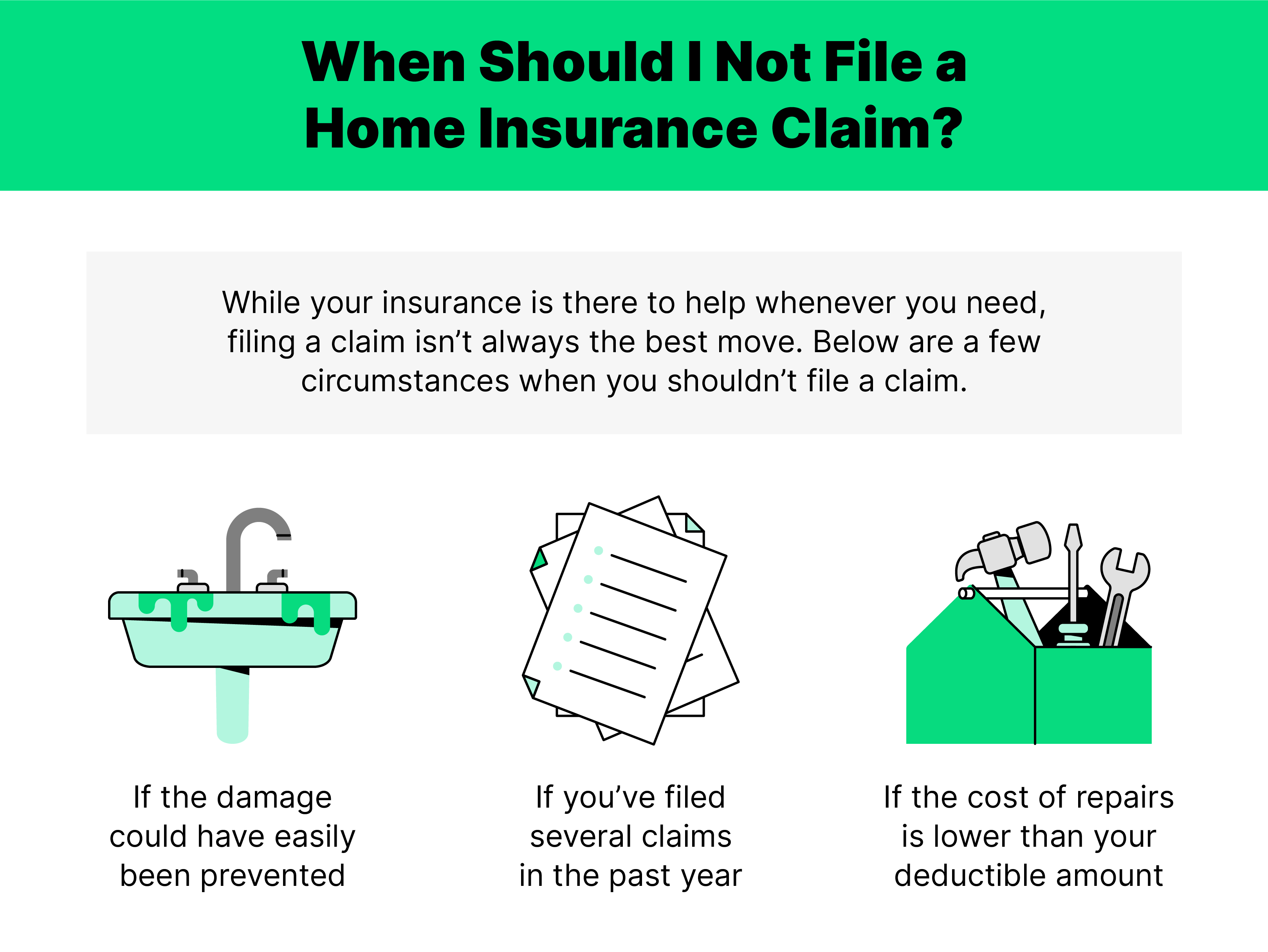

You are eligible to file an insurance claim if the incident is covered under your insurance policy. It is important to review your policy and understand your coverage before filing a claim.

What information and documents do I need to file an insurance claim?

You will typically need your insurance policy number, details about the incident, any photos or documentation of damages, and any other relevant information requested by your insurance company.

Can I file an insurance claim online?

Yes, most insurance companies allow you to file a claim online through their website or mobile app. However, you can also file a claim over the phone or in person at your insurance company’s office.

What should I do after filing an insurance claim?

After filing a claim, you should keep all documentation and records related to the incident and your claim. You may also need to schedule an inspection or provide further information to your insurance company.

How long does it take for an insurance claim to be processed?

The time it takes for an insurance claim to be processed varies depending on the complexity of the claim. It can take anywhere from a few days to several weeks, so it is important to follow up with your insurance company for updates on your claim.