How the Insurance Reimbursement Process Works

Anúncios

Navigating the realm of insurance reimbursement can often appear daunting; however, a comprehensive understanding of its intricacies is essential for maximizing benefits.

This article delineates the fundamental components of insurance reimbursement, including its definition, the step-by-step process involved, and the various types of insurance plans available. Readers will also gain insight into common terminology, potential challenges, and strategies to facilitate a more streamlined reimbursement experience.

Whether one is a seasoned policyholder or new to the domain of insurance, this guide aims to provide clarity and support in comprehending the complexities associated with insurance reimbursement.

Understanding Insurance Reimbursement

Understanding insurance reimbursement is crucial for both patients and healthcare providers, as it encompasses the comprehensive process of claiming costs associated with medical services.

Anúncios

Insurance reimbursement refers to the payments made by insurance companies to healthcare providers for services rendered to policyholders that are covered under their plans. This intricate process consists of several key steps, including eligibility verification, claim submission, and payment processing, while also taking into account patient responsibilities, such as copayments and deductibles.

Furthermore, comprehending how reimbursement rates are established and the specific details of insurance policies can give the power to patients to effectively navigate their healthcare expenses.

What is Insurance Reimbursement?

Insurance reimbursement refers to the payment that healthcare providers receive from insurance companies for the medical services rendered to patients covered by their insurance policies.

This process commences when a healthcare provider delivers a service, which is subsequently documented through precise medical coding that captures the diagnoses and treatments provided. Insurance companies rely on these codes to assess the validity and value of the claims submitted for reimbursement.

For both healthcare professionals and patients, understanding the intricacies of reimbursement policies is essential, as it not only impacts the timeliness of provider compensation but also influences patients’ out-of-pocket expenses.

A thorough understanding of these policies can give the power to patients to make informed decisions about their healthcare and effectively navigate potential disputes related to their coverage.

The Insurance Reimbursement Process

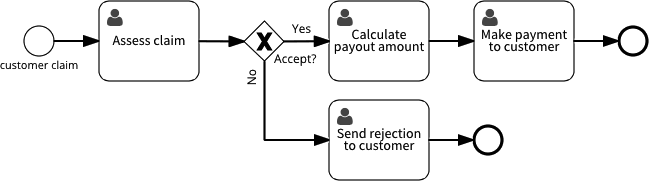

The insurance reimbursement process is a comprehensive, multi-step procedure that commences with patient appointments and concludes with the payment made to healthcare providers for their services. This process encompasses several essential steps, beginning with eligibility verification to confirm whether the services are covered by the patient’s insurance policy.

Subsequently, healthcare providers must gather detailed documentation of the services rendered and submit insurance claims using standardized claim forms. These claims are then reviewed by insurance adjusters to determine their status.

A thorough understanding of each phase of this process, including potential reimbursement timelines and the significance of accurate claim submission, is vital for achieving successful resolutions of claims.

Step-by-Step Guide to Reimbursement

A comprehensive step-by-step guide to reimbursement serves to clarify the claims management process for both healthcare providers and patients, ensuring that all parties comprehend their respective roles.

From the initial patient appointment, during which essential information is collected and documented, to the eventual submission of insurance claims, this guide addresses each critical stage of the process. Effective communication between healthcare providers and patients is vital to elucidate benefits, copayments, and deductible amounts. Accurate documentation is fundamental for claim submissions, minimizing the risk of delays and denials.

After the claim has been filed, monitoring its status becomes crucial; timely follow-ups can significantly influence the likelihood of securing reimbursement. Through proactive communication and diligent record-keeping, both patients and providers can effectively navigate adjustments and resolve any arising issues.

Types of Insurance Plans

Understanding the various types of insurance plans is essential for both patients and healthcare providers, as these plans significantly impact the coverage and reimbursement processes for medical services rendered.

Different insurance plans, including employer-sponsored plans, government programs such as Medicare and Medicaid, and private insurance policies, possess unique characteristics that dictate reimbursement rates and patient responsibilities.

Additionally, each plan may designate primary and secondary insurances, which influence the overall coordination of benefits and determine out-of-pocket expenses as well as service authorizations.

Different Types of Coverage

Different types of insurance coverage can significantly impact the reimbursement claims process, as they dictate which services are covered and the extent of those benefits.

For example, comprehensive coverage typically encompasses a wide range of services, often resulting in higher reimbursement rates for healthcare providers and reduced out-of-pocket expenses for patients.

Conversely, catastrophic plans, which are intended to safeguard against severe health events, may entail higher deductibles that influence the upfront costs patients must bear before benefits are activated.

Similarly, limited benefit plans, which provide lower maximum payouts, can impose considerable financial responsibility on individuals, particularly when unexpected medical expenses arise.

Understanding these distinctions is essential for patients as they navigate their healthcare needs and associated costs.

Common Terminology in Insurance Reimbursement

Familiarity with common terminology in insurance reimbursement is essential for comprehending the complexities of the claims process and patient billing.

Key terms, such as Explanation of Benefits (EOB), provide detailed information regarding how claims are processed and outline the patient’s financial responsibilities, thereby clarifying the amounts owed after services are rendered.

Furthermore, a thorough understanding of billing codes, including CPT and ICD codes, is imperative for accurate claims submission. This knowledge can mitigate potential issues such as claims denial, insurance fraud, and billing disputes.

Key Terms to Know

Understanding key terms related to insurance reimbursement equips patients to navigate healthcare costs and the claims process more effectively.

By familiarizing themselves with concepts such as deductibles, copayments, and out-of-pocket maximums, individuals can gain valuable insights into their financial obligations when receiving medical services.

For example, a deductible refers to the amount a patient must pay out-of-pocket before their insurance coverage begins to apply to expenses. Copayments, on the other hand, are fixed fees associated with specific services, such as physician visits or prescription medications.

Recognizing the differences between in-network and out-of-network providers is essential, as these distinctions significantly affect reimbursement levels and overall healthcare costs. Awareness of these terms not only aids patients in making informed decisions regarding their care but also give the power tos them to engage proactively in discussions with healthcare providers and insurers about their medical bills.

Challenges in the Reimbursement Process

Challenges in the reimbursement process can significantly impede healthcare providers’ ability to receive timely payments, often resulting in frustration for both providers and patients.

Common issues include claims denials, which may occur due to incomplete claim documentation, inaccuracies in billing codes, or insufficient medical necessity for the services rendered.

Furthermore, billing disputes may arise regarding patient responsibility, copayments, and deductibles, necessitating a comprehensive understanding of claims management to effectively navigate these challenges.

Common Issues and How to Overcome Them

Common issues in the reimbursement process can often be addressed through a combination of patient advocacy and a thorough understanding of the appeal process.

By actively engaging with both healthcare providers and insurers, individuals can facilitate smoother transactions and reduce the likelihood of delays. It is essential to remain informed about the specific submission requirements and to follow up regularly on the status of claims. Timely adjustments to claims can prevent potential denials and promote quicker reimbursements.

Advocating for oneself or seeking assistance from professionals who specialize in navigating the complexities of insurance can significantly expedite the resolution of disputes. By fostering open communication with both parties, clarity is enhanced, thereby streamlining the overall reimbursement timeline.

Tips for a Smooth Reimbursement Process

Implementing best practices is essential for facilitating a more efficient reimbursement process, thereby minimizing delays and ensuring that healthcare providers receive timely payment for their services.

Important recommendations include maintaining precise claim documentation and ensuring that all requisite information is included when submitting claims to insurance companies.

Furthermore, comprehending financial responsibility and educating patients about their insurance benefits can significantly enhance payment processing and reduce the incidence of billing disputes.

Best Practices for Successful Reimbursement

Adopting best practices for successful reimbursement can significantly enhance the efficiency of the claims process and improve patient satisfaction.

By concentrating on effective claim tracking, healthcare providers can promptly identify any discrepancies, ensuring that issues are addressed swiftly before they escalate. Establishing clear insurance agreements is essential, as these agreements delineate coverage limits and co-payment responsibilities, thereby reducing misunderstandings between patients and providers.

It is equally important to secure all necessary service authorizations prior to patient treatment, as this can prevent claim denials that lead to delayed payments. Furthermore, payment reconciliation plays a critical role in this ecosystem; it facilitates the regular assessment of incoming payments against outstanding claims, ultimately assisting healthcare providers in maintaining their financial health and operational efficiency.

Frequently Asked Questions

How does the insurance reimbursement process work?

The insurance reimbursement process is the procedure in which an insurance company pays for the medical expenses incurred by an insured individual. It requires the submission of a claim, review and approval by the insurance company, and payment of the approved amount.

What is a claim in the insurance reimbursement process?

A claim is a formal request submitted to the insurance company to cover the cost of medical services received by an insured individual. It includes details of the services rendered, the cost, and any other relevant information required by the insurance company.

What happens after a claim is submitted?

After a claim is submitted, the insurance company will review the request and determine if it meets the criteria for reimbursement. This may involve verifying the information provided and assessing the coverage of the insured individual’s insurance policy.

How long does the insurance reimbursement process take?

The time it takes for the insurance reimbursement process to be completed varies depending on the insurance company and the complexity of the claim. Typically, it can take anywhere from a few days to a few weeks to receive reimbursement.

Can a claim be denied in the insurance reimbursement process?

Yes, a claim can be denied during the insurance reimbursement process for various reasons such as insufficient information, lack of coverage for the services rendered, or failure to meet the terms and conditions of the insurance policy. If a claim is denied, the insured individual can appeal the decision.

What happens after a claim is approved?

After a claim is approved, the insurance company will issue payment to the healthcare provider or directly to the insured individual, depending on the terms of the policy. The approved amount may also be adjusted based on the coverage and any deductibles or co-payments outlined in the policy.