Essential Insurance Policies for Young Professionals

Anúncios

Navigating the realm of insurance can be a challenging endeavor for young professionals; however, comprehending the appropriate coverage is essential for securing one’s financial future.

This article delineates the essential insurance policies tailored to meet individual needs, including health, life, and disability insurance.

It is important to explore various options to assist in selecting the most suitable health plan, evaluating life insurance policies, and understanding the advantages of disability coverage.

Furthermore, we will examine auto, renters, and umbrella insurance, ensuring that individuals have a comprehensive safety net in place.

Anúncios

By acquiring the necessary knowledge, young professionals can give the power to themselves to make informed insurance decisions.

Understanding Insurance for Young Professionals

Understanding insurance is essential for young professionals, as it establishes the foundation for financial security. Many individuals encounter the complexities of adult life for the first time, making navigation of the insurance marketplace a potentially daunting task.

Critical insurance policies, including health insurance, auto insurance, and renters insurance, are vital for protection against unforeseen circumstances. Additionally, it is imperative for young adults to evaluate coverage options and premium costs to achieve a balance between financial independence and effective risk management.

By conducting a thorough insurance needs assessment, young professionals can more accurately identify the most appropriate coverage types for their specific situations.

Why Insurance is Important for Young Professionals

Insurance is essential for young professionals as it provides a safety net that ensures financial security against unexpected challenges and risks.

These safeguards extend beyond the provision of peace of mind; they enable individuals to effectively manage potential financial burdens associated with health issues, accidents, or even job loss. Recognizing the unpredictable nature of life, young professionals can benefit from various types of insurance specifically tailored to their circumstances.

For instance, health insurance not only covers medical expenses but also underscores the importance of preventive care. Additionally, renters’ or homeowners’ insurance protects personal belongings against theft or damage, highlighting the necessity of comprehensive planning for unforeseen events.

Ultimately, by integrating effective risk management strategies into their lives, individuals can navigate uncertainties with increased confidence.

Health Insurance Options

Health insurance options for young professionals exhibit considerable variation, providing a range of coverage choices designed to address diverse needs and preferences.

These options include critical illness insurance and plans that accommodate pre-existing conditions.

Types of Health Insurance Plans

There are several types of health insurance plans available, each differing in coverage options, deductibles, and policy limits, which are essential for young professionals to comprehend.

Among the most prevalent options are:

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- High-deductible health plans (HDHPs)

HMOs typically require members to select a primary care physician and obtain referrals to see specialists, offering reduced costs but limited flexibility. Conversely, PPOs provide greater freedom to choose any healthcare provider within their network, though patients may incur higher out-of-pocket expenses for services rendered by out-of-network providers.

High-deductible health plans are attractive for individuals seeking lower premiums; however, they feature higher deductibles, necessitating careful consideration of potential healthcare needs.

Provider networks are a critical component of these plans, as they significantly influence access to care. They determine which doctors, hospitals, and services are accessible to policyholders, thereby directly affecting overall healthcare accessibility.

How to Choose the Right Plan

Selecting an appropriate health insurance plan necessitates a thorough analysis of individual health requirements, financial considerations, and a comprehensive understanding of insurance principles.

Navigating the extensive array of options available can often be daunting; however, making a well-informed decision is essential for achieving long-term wellness and financial security.

Individuals should begin by comparing various insurance quotes to identify plans that best meet their specific needs. This process should encompass not only an examination of monthly premiums but also a careful assessment of out-of-pocket expenses, deductibles, and the networks of healthcare providers.

Furthermore, recommendations regarding coverage features—such as preventive services and emergency care—can significantly impact overall satisfaction with the selected plan. Ultimately, aligning the choice of a health insurance plan with personal financial objectives will contribute to a more secure and manageable healthcare experience.

Life Insurance Policies

Life insurance policies, including term life insurance and whole life insurance, are critical for young professionals aiming to secure their financial future and safeguard their loved ones.

Thoughtful beneficiary designations are an important aspect of these policies, ensuring that the intended recipients are adequately protected.

Types of Life Insurance Policies

In the realm of life insurance, the two most prevalent types of policies are term life insurance and whole life insurance, each presenting distinct advantages based on individual circumstances.

Term life insurance is specifically structured to provide coverage for a designated period, making it a more economical option for many individuals. Its premiums are typically lower than those associated with whole life insurance, which is intended to remain in force for the entirety of the policyholder’s life and to accumulate cash value over time. This cash value feature allows policyholders to borrow against their policy or access those funds when necessary; however, it is important to note that this benefit is accompanied by higher premiums.

Additionally, both types of insurance may have tax implications; for example, death benefits from life insurance are generally exempt from taxation.

Conversely, critical illness insurance serves as a valuable supplement by offering a lump sum payment upon the diagnosis of a serious health condition. This benefit can alleviate the financial burden during the recovery process and should be considered when assessing overall insurance needs.

Factors to Consider When Choosing a Policy

When selecting a life insurance policy, it is imperative to consider several factors, including premium costs, coverage gaps, and overall financial planning objectives.

For young professionals, it is essential to look beyond immediate expenses and assess how a policy can contribute to the security of their future aspirations. Life circumstances, such as career advancements, marriage, or starting a family, frequently result in changing insurance needs. Consequently, conducting a comprehensive comparison of available policies is crucial to identify which one offers the most advantageous benefits tailored to individual requirements.

Additionally, evaluating the policy’s flexibility to adapt to life changes ensures that it remains relevant and effective in providing peace of mind as circumstances evolve.

Disability Insurance

Disability insurance functions as an essential financial safety net for young professionals, offering income protection in the event of a disability that renders them unable to work.

What is Disability Insurance?

Disability insurance is a form of coverage that provides financial support to individuals who become unable to work due to illness or injury. This essential protection enables individuals to maintain their standard of living by replacing a portion of their income during periods of unexpected hardship.

There are various coverage options available, including short-term and long-term policies, which address different needs based on the duration of the inability to work. The process of filing a claim typically necessitates the submission of medical documentation along with the completion of forms to verify eligibility.

It is imperative for individuals to understand their financial responsibilities, as this knowledge plays a significant role in risk assessment and in determining the benefits they may require in the event of a claim.

Benefits and Coverage Options

The benefits of disability insurance extend beyond mere financial compensation, providing a range of coverage options that offer peace of mind for young professionals.

These policies may encompass both short-term and long-term coverage, allowing individuals to select an option that aligns with their specific circumstances. Many plans also include riders that enhance benefits, such as cost-of-living adjustments or coverage for partial disabilities.

Understanding the claims process is equally crucial, as an efficient and streamlined system can facilitate quicker access to funds when they are needed the most. Customized plans can be tailored to accommodate various occupations and lifestyles, ensuring that specific situations, such as self-employment or high-risk professions, are adequately addressed.

Possessing disability insurance serves as a vital safety net, providing support to individuals during unforeseen challenges.

Other Essential Insurance Policies for Young Professionals

Along with health and disability insurance, young professionals should evaluate other essential insurance policies, such as auto insurance, renters insurance, and homeowners insurance, to ensure comprehensive coverage against a range of potential risks.

Auto Insurance

Auto insurance is a vital component of financial planning for young professionals, offering essential coverage options such as auto liability and uninsured motorist protection.

It is imperative to understand the nuances of various coverage types to make informed decisions. Liability coverage serves to protect the insured from potential financial losses in the event that they are found responsible for an accident, while collision coverage addresses damages to their own vehicle following an incident.

Comprehensive coverage extends beyond this, including protection against theft, vandalism, and natural disasters. When evaluating premiums, young professionals should consider the deductible amounts and how these may affect their out-of-pocket expenses in the event of a claim.

Ultimately, a thorough assessment of personal driving habits, vehicle age, and financial circumstances can significantly impact the selection of an appropriate insurance package that aligns with individual needs.

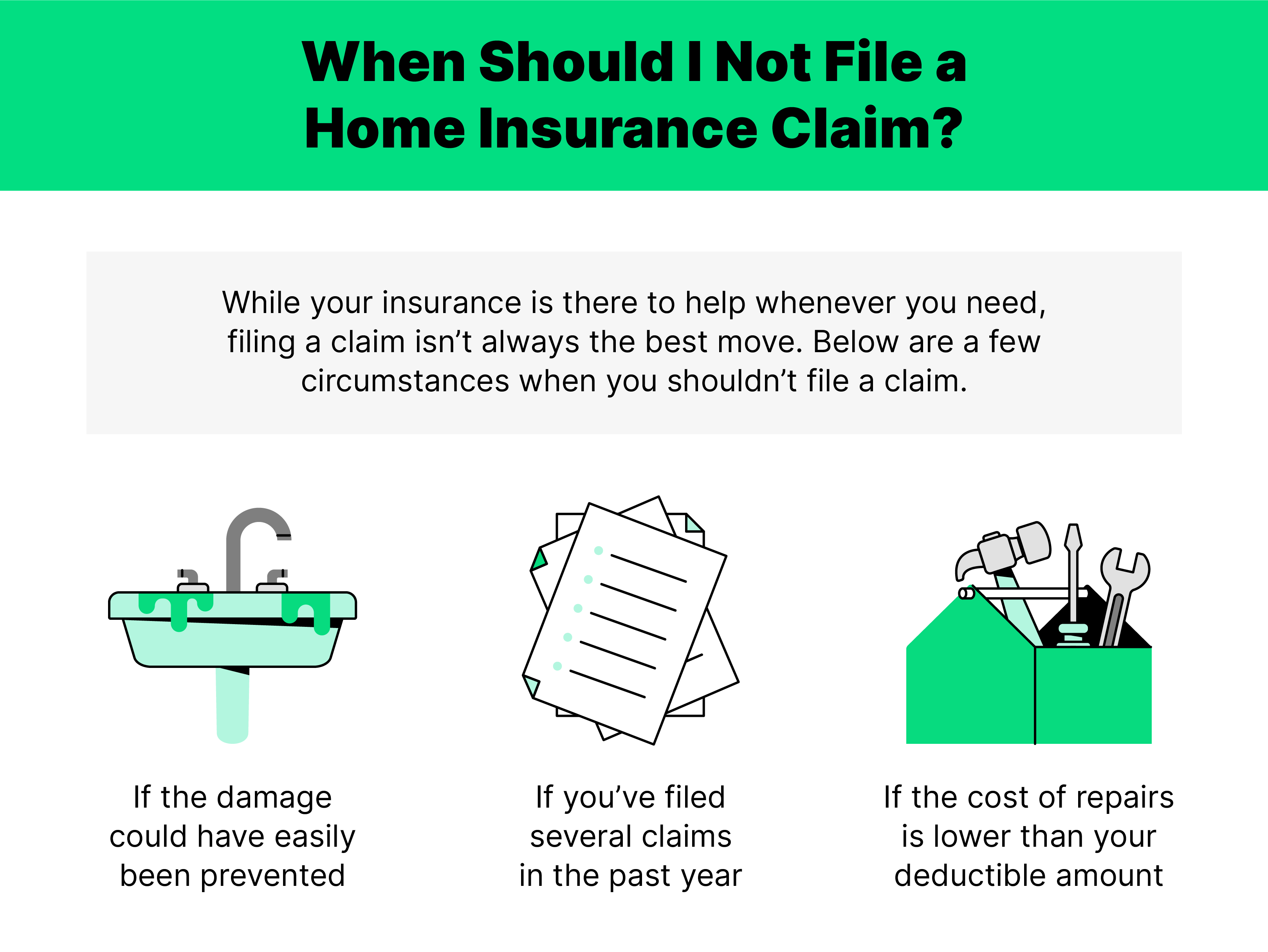

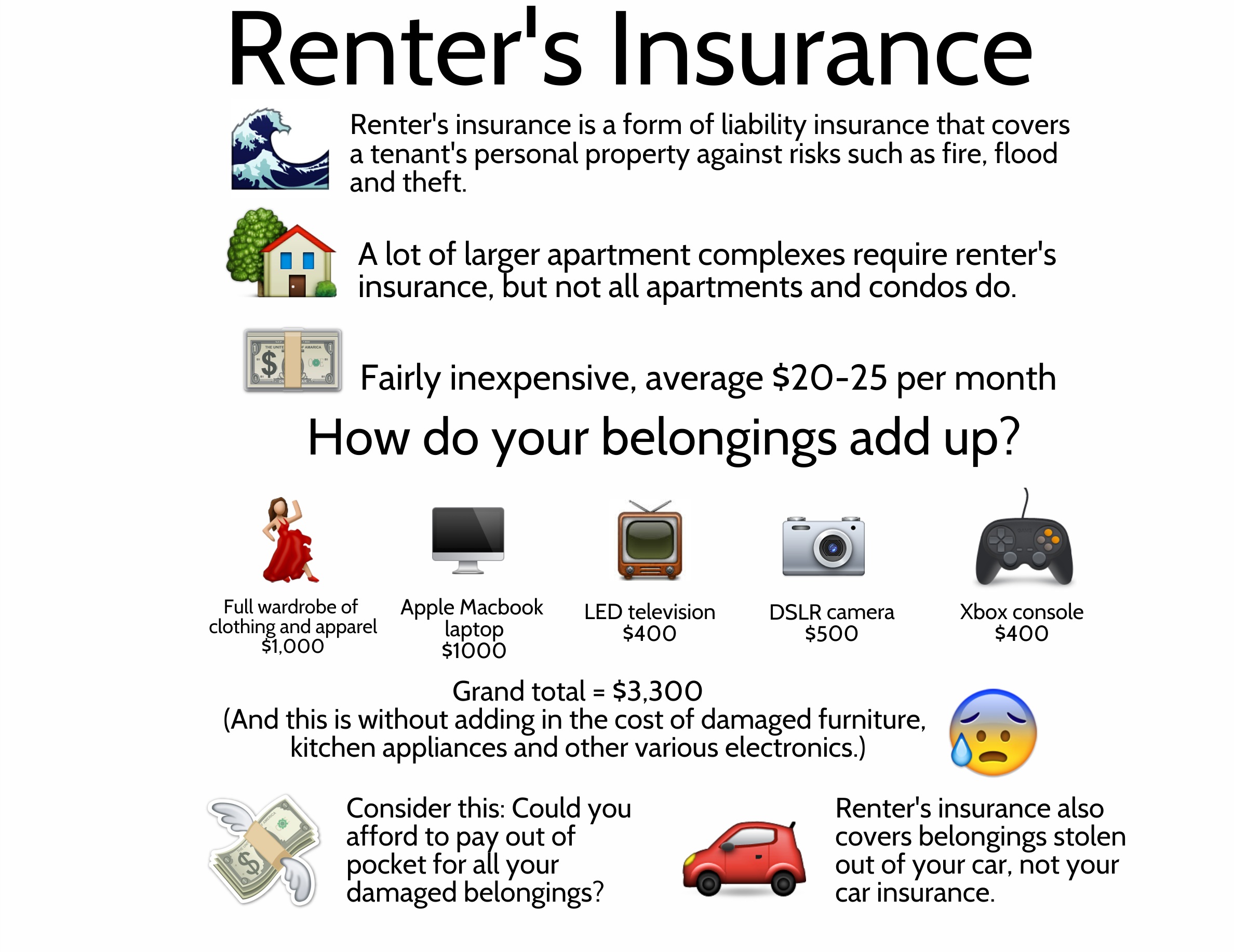

Renters or Homeowners Insurance

For individuals renting or owning a home, selecting the appropriate insurance policy is essential for the protection of personal property and the assurance of financial security.

Renters insurance specifically protects personal belongings within a leased space, covering losses resulting from theft, fire, or other hazards, while also providing liability protection. In contrast, homeowners insurance not only covers the structural aspects of the home but typically includes coverage for personal belongings and liabilities as well, thus offering a broader scope of protection due to the ownership of both the land and the dwelling.

It is imperative for individuals to thoroughly examine the differences in coverage options, as well as the specific exclusions that may impact their claims. Each policy can vary significantly depending on the insurance provider, making it crucial for both renters and homeowners to fully understand the details of their insurance policies in order to avoid unexpected out-of-pocket expenses.

Umbrella Insurance

Umbrella insurance is a vital component of an individual’s insurance portfolio, providing additional liability coverage that exceeds standard policy limits and addressing potential coverage gaps.

This type of insurance serves as a comprehensive safety net, offering broader protection against claims such as personal injury, property damage, and certain lawsuits that may surpass the limits of a homeowner’s or auto insurance policy.

By including umbrella insurance in their coverage, individuals can enhance their overall financial responsibility, ensuring protection against unforeseen circumstances that could result in significant financial burdens.

To effectively implement this type of coverage, it is essential to evaluate existing insurance policies, identify any vulnerabilities, and ascertain an appropriate level of additional coverage that aligns with one’s unique lifestyle and risk exposure.

As part of a comprehensive risk management strategy, umbrella insurance not only provides protection against unexpected liabilities but also promotes peace of mind, assuring individuals that they are well-prepared for life’s uncertainties.

Frequently Asked Questions

What are essential insurance policies for young professionals?

Essential insurance policies for young professionals are insurance plans specifically designed to address the financial needs and risks faced by individuals who are just starting their careers.

Why should young professionals consider getting insurance?

Young professionals should consider getting insurance to protect themselves and their future from unexpected events such as accidents, illnesses, or disabilities, which can greatly impact their financial stability.

What are the different types of essential insurance policies for young professionals?

The different types of essential insurance policies for young professionals include health insurance, life insurance, disability insurance, renters insurance, and professional liability insurance.

Is health insurance necessary for young professionals?

Yes, health insurance is necessary for young professionals because it not only covers medical expenses but also provides preventive care and financial protection in case of an illness or injury.

Why do young professionals need life insurance?

Young professionals need life insurance to provide financial support to their loved ones in case of an untimely death. It can also serve as a savings tool for future needs such as buying a home or starting a family.

What is professional liability insurance and why is it important for young professionals?

Professional liability insurance, also known as errors and omissions insurance, protects young professionals from claims of negligence or inadequate work. It is important for professionals who provide services or advice to clients, such as lawyers, doctors, or consultants.