Best Methods to Track Your Monthly Expenses

Anúncios

Tracking monthly expenses is an essential step in achieving financial health and stability. Gaining an understanding of where your money is allocated enables you to make informed decisions, avoid unnecessary debt, and ultimately save for your financial goals.

This article examines the benefits of monitoring spending, compares popular manual and digital tracking methods, and offers guidance for establishing a realistic budget tailored to your income level.

Additionally, readers will discover essential tools and common pitfalls to avoid, ensuring they are well-equipped to manage their finances effectively.

Why Tracking Monthly Expenses is Important

Tracking monthly expenses is crucial for effective financial management and personal finance, as it offers valuable insights into spending habits, aids in the achievement of financial goals, and promotes fiscal discipline.

Anúncios

By meticulously monitoring expenses, individuals can identify opportunities for cost reduction, allocate savings more efficiently, and maintain a comprehensive overview of their financial health.

This practice not only enhances financial literacy but also enables individuals to make informed decisions regarding their income and spending behaviors.

Furthermore, comprehending the intricacies of monthly expenses facilitates improved budgeting and planning, ultimately contributing to greater financial stability.

Benefits of Monitoring Your Spending

Monitoring personal expenditures presents numerous advantages that enhance financial control. These include improved cost analysis, enhanced budgeting capabilities, and valuable financial insights that facilitate knowledge-based decision making.

By actively tracking their expenditures, individuals can identify unnecessary costs, thereby simplifying the process of reducing discretionary spending. This practice not only contributes to increased savings rates but also encourages the development of more prudent spending habits over time.

Utilizing a variety of financial tools and resources enables individuals to gain a comprehensive understanding of their financial health, leading to more strategic decision-making. Ultimately, the ability to monitor expenses enables individuals with the necessary knowledge to make informed choices, ensuring that their financial resources are used in the most effective and efficient manner.

Popular Methods for Tracking Expenses

There are several widely recognized methods for tracking expenses, which range from traditional spreadsheets to contemporary mobile applications and advanced accounting software.

Each of these options caters to various preferences and financial management approaches.

Manual vs. Digital Methods

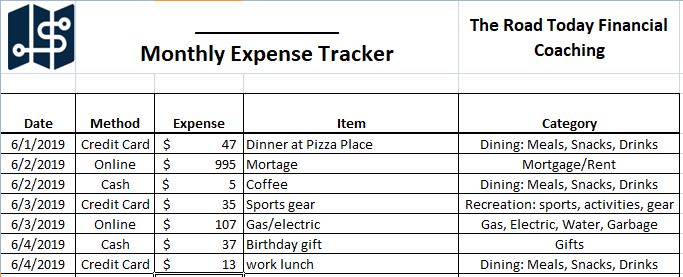

When considering expense tracking, individuals may choose between manual tracking methods, such as utilizing spreadsheets, and digital tracking methods, which typically involve user-friendly applications and software designed for efficient expense management.

Each method presents distinct advantages and disadvantages that can significantly impact one’s budgeting techniques. Manual tracking provides greater control and a personalized approach, allowing individuals to customize their spreadsheets to meet specific needs; however, it can be more time-consuming and susceptible to human error.

In contrast, digital tracking methods offer automation and immediate insights into spending habits, facilitating the generation of reports and rapid data analysis. Nonetheless, some users may find the learning curve associated with certain applications to be somewhat challenging, or they may prefer the tactile experience of using pen and paper.

Ultimately, the decision between manual and digital tracking should be guided by individual preferences, comfort with technology, and specific financial objectives.

Creating a Budget for Tracking Expenses

Establishing a budget is a crucial step in effectively tracking expenses. This process entails careful budget planning, appropriate allocation of funds, and necessary adjustments to ensure alignment with financial objectives and to foster fiscal discipline.

Tips for Setting a Realistic Budget

To establish a realistic budget that aligns with your financial goals, it is advisable to employ effective budgeting techniques, set clear expense limits, and ensure sustainability in spending habits.

Begin by analyzing historical spending patterns to identify trends and areas for potential adjustments. This process entails reviewing bank statements, credit card bills, and receipts to gain a comprehensive understanding of monthly cash flow.

Utilizing financial management tools can further facilitate this process by enabling individuals to track expenses efficiently and providing a visual representation of spending habits.

It is essential to balance fixed and variable costs while maintaining accountability through regular budget reviews. This practice ensures that spending remains within established limits, thereby promoting a disciplined approach to achieving financial objectives.

Tools and Apps for Expense Tracking

A diverse array of tools and applications is available for expense tracking, encompassing everything from basic mobile applications to sophisticated financial software and budgeting tools designed to accommodate various income levels and financial management requirements.

Top Picks for Budgeting and Tracking Apps

The leading choices for budgeting and tracking applications include platforms that excel in expense tracking and provide interactive tools for financial insights, rendering them both user-friendly and effective for managing personal finances.

These applications address a wide array of user needs, accommodating those who prefer simplicity as well as those who require advanced functionalities.

For example, some applications offer detailed categorization of expenses, enabling individuals to discern spending patterns and identify areas for improvement. Others incorporate goal-setting features, which assist users in maintaining motivation as they strive towards their financial objectives.

Many of these platforms also provide real-time synchronization with bank accounts, ensuring precise tracking of all transactions. By evaluating their distinct strengths and user experiences, it becomes clear that selecting the appropriate application can significantly enhance an individual’s capacity to maintain a well-organized financial life.

Expense Tracking Tips for Different Income Levels

Expense tracking strategies can vary considerably based on individual income levels, necessitating customized financial approaches to facilitate effective budget adjustments and achieve financial success across diverse economic conditions.

Strategies for Low, Middle, and High Income Earners

Different income levels necessitate distinct budgeting strategies. Low-income earners typically focus on essential expenses, while middle-income earners strive to balance saving and spending. High-income earners, on the other hand, prioritize managing investments and luxury expenses.

For individuals with limited financial means, tracking expenses often involves prioritizing needs over wants, ensuring that every dollar is allocated to a critical purpose. They may employ straightforward methods such as minimalistic spreadsheets or specialized apps designed for tracking basic expenditures across categories like food, housing, and transportation. This approach allows them to identify potential areas for cost-cutting when necessary.

Conversely, individuals with moderate incomes can implement more sophisticated systems that utilize budgeting applications to effectively allocate portions of their income. This promotes a habit of saving while permitting moderate discretionary spending.

Higher-income individuals may find value in comprehensive financial management tools that not only track daily expenses but also facilitate investment planning. This ensures that their financial health remains as robust as their earnings.

Common Mistakes to Avoid When Tracking Expenses

Avoiding common mistakes in expense tracking is essential for maintaining financial accountability and deriving meaningful insights from expenditures.

This practice can significantly enhance budgeting effectiveness and contribute to the improvement of overall financial habits.

Pitfalls and How to Overcome Them

Identifying pitfalls in expense tracking, such as overspending or inaccuracies in transaction categorization, is essential for overcoming these issues and maintaining effective financial discipline.

These challenges can result in confusion and stress, hindering individuals’ ability to comprehend their true financial standing.

To effectively address these concerns, it is crucial to adopt a consistent tracking routine, ensuring that every expense is recorded promptly and accurately.

Utilizing expense reports can provide valuable insights into spending habits, facilitating more informed financial decision-making. Proper categorization of expenses not only highlights areas of overspending but also aids individuals in establishing realistic budgets.

By recognizing these common pitfalls and implementing strategic solutions, individuals can enhance their financial health significantly.

Frequently Asked Questions

What are the best methods to track your monthly expenses?

There are several effective methods to track your monthly expenses, including creating a budget, using expense tracking apps, and keeping a spending journal.

How can creating a budget help with tracking monthly expenses?

Creating a budget allows you to allocate a specific amount of money for each expense category, making it easier to track and control your spending.

What are some popular expense tracking apps?

Some popular expense tracking apps include Mint, Personal Capital, and YNAB. These apps allow you to connect your accounts and automatically track your expenses.

What is the benefit of keeping a spending journal?

Keeping a spending journal allows you to manually track and record your expenses, giving you a better understanding of your spending habits and areas where you can cut back.

How often should I track my monthly expenses?

It is recommended to track your expenses at least once a week to stay on top of your spending. However, tracking daily can provide even more accurate results.

Is it important to review my expenses regularly?

Yes, reviewing your expenses regularly is crucial for staying on track with your budget and identifying any areas where you may need to adjust your spending habits.