A Practical Guide to Building and Maintaining a Good Credit Score

Anúncios

In the current financial landscape, comprehending one’s credit score is of paramount importance.

This guide is designed to assist individuals in navigating the complexities of credit scores—covering what they are, their significance, and the factors that influence them.

Readers will uncover effective strategies for building and maintaining a strong credit score, including insights on establishing credit, enhancing one’s score, and avoiding prevalent pitfalls.

Regardless of whether one is commencing their credit journey or seeking to improve their financial health, this guide provides comprehensive support.

Anúncios

Understanding Credit Scores

Understanding credit scores is crucial for individuals aiming to navigate the financial landscape with competence. A credit score serves as a numerical representation of a person’s creditworthiness, derived from their credit history, credit report, and various financial behaviors.

This score is instrumental in influencing loan approval, interest rates, and overall financial well-being. By comprehending the fundamentals of credit scores, individuals can adopt more effective credit education and monitoring practices, which facilitate improved financial decision-making and strategies for credit building over time.

What is a Credit Score?

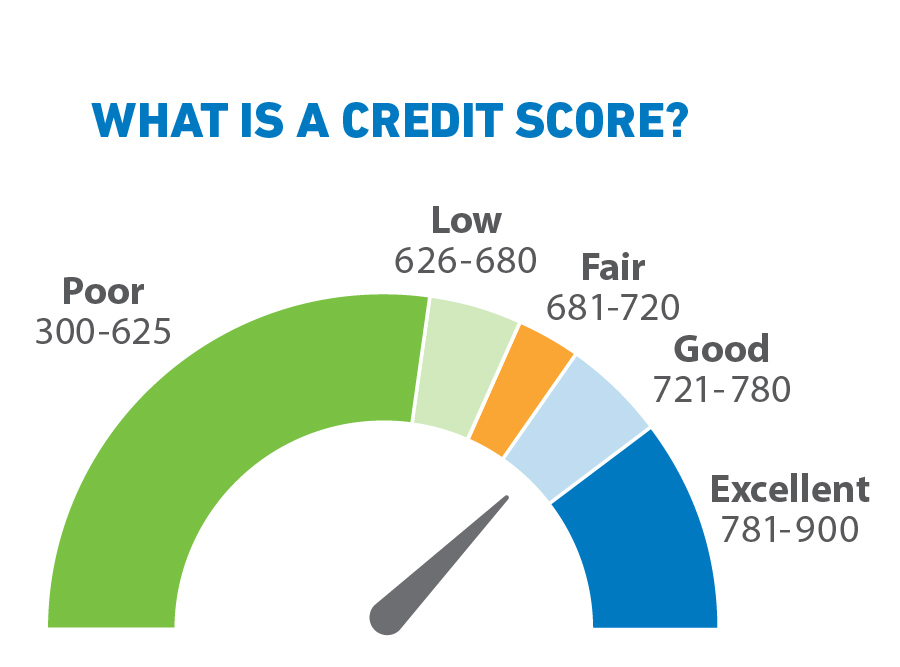

A credit score is a numerical representation of an individual’s creditworthiness, derived from a credit scoring model such as the FICO score or VantageScore, and based on the information contained in the credit report.

This score typically ranges from 300 to 850, with higher scores signifying greater creditworthiness. Several factors contribute to this score, including payment history, amounts owed, length of credit history, types of credit utilized, and the number of new credit inquiries.

Each scoring model evaluates these factors with varying emphasis; for example, FICO scores often prioritize payment history and credit utilization over newer accounts, whereas VantageScore may place greater weight on recent credit inquiries.

Understanding these distinctions enables individuals to make informed financial decisions and enhances their prospects of obtaining favorable loan terms or credit approvals in the future.

Why is it Important?

The significance of a credit score cannot be understated, as it plays a critical role in influencing loan approval processes, determining interest rates, and assessing overall financial health by reflecting an individual’s creditworthiness to lenders.

For example, individuals with higher credit scores often enjoy more favorable terms when applying for a mortgage; borrowers with scores exceeding 740 can secure interest rates that are substantially lower than those available to individuals with scores below 620. This variation can result in significant savings, amounting to thousands of dollars throughout the life of the loan.

A robust credit score is also essential when considering rental opportunities, as many landlords utilize credit scores to evaluate tenant reliability, which can directly impact rental applications.

According to a study by FICO, 90% of leading lenders incorporate credit scores into their decision-making processes, highlighting its critical role in financial planning and stability across various life stages.

Factors that Affect Credit Scores

Several key factors significantly influence an individual’s credit score, including payment history, credit utilization, length of credit history, credit inquiries, and the diversity of credit accounts.

Each of these elements plays a crucial role in how lenders evaluate an individual’s creditworthiness.

Payment History

Payment history is a crucial element of a credit score, as it represents an individual’s record of timely payments compared to late payments. This history significantly influences overall creditworthiness as evaluated by credit reporting agencies.

Not only does it demonstrate financial responsibility, but it also plays an essential role in determining access to credit and the interest rates that lenders may extend. A strong payment history can result in more favorable terms for loans and credit cards, whereas missed payments can severely limit these opportunities.

To maintain a solid payment record, individuals may implement various strategies, including:

- Setting reminders for payment due dates

- Utilizing automatic payment options

- Establishing a budget to prevent overspending

It is also crucial to communicate with creditors in the event of financial difficulties, as they may provide flexible payment plans that assist in managing expenses without compromising credit health.

Amount of Debt

The amount of debt an individual carries, particularly as reflected in the credit utilization ratio, is a significant factor in determining their credit score; high levels of debt can negatively impact creditworthiness.

This ratio compares the total amount of credit being utilized to the total credit available, and it is advisable to maintain it below 30% to preserve a healthy credit score. When individuals exceed this benchmark, lenders may perceive them as high-risk borrowers.

To effectively manage debt and enhance credit scores, it is essential to adopt practical strategies, such as:

- Regularly monitoring credit reports for errors

- Making timely payments

- Reducing outstanding balances

Individuals may also consider seeking debt management programs or utilizing budgeting tools to track expenses, ensuring that they remain within their limits and gradually improve their credit utilization ratios.

Credit History Length

The length of credit history is a significant factor influencing credit scores, as it provides lenders with valuable insights into an individual’s credit behavior over time, thereby contributing to long-term credit growth.

A substantial credit history reflects an individual’s capacity to manage debt responsibly, which can enhance lenders’ confidence in a borrower’s reliability. This is why older, well-managed accounts can have a considerable positive impact on one’s credit score.

Establishing a robust credit history requires patience and consistent financial practices. Regularly making on-time payments, maintaining low credit utilization, and preserving older credit accounts without closing them serve as indicators of fiscal responsibility.

Over time, these practices not only positively affect credit scores but also create opportunities for improved loan terms and lower interest rates, ultimately facilitating healthier financial decisions in the future.

New Credit

New credit accounts and associated credit inquiries can significantly impact credit scores, as they may indicate increased risk to lenders and consequently affect an individual’s overall creditworthiness evaluation.

When an individual opens a new credit account, it results in a hard inquiry on their credit report, which can temporarily lower their score. However, responsibly managing these accounts can enhance credit history over time, potentially leading to improved credit scores in the long term.

It is crucial to carefully weigh the advantages of increased credit limits and a diversified credit mix against the risks of accumulating debt and diminishing one’s credit score. To mitigate negative effects, individuals should consider the following strategies:

- Spacing out credit applications

- Only applying for credit when necessary

- Ensuring timely payments on all accounts to maintain a healthy financial profile

Credit Mix

A diverse credit mix, which encompasses a combination of installment loans and revolving credit, can positively impact credit scores by demonstrating an individual’s capacity to manage various types of credit accounts.

This diversity not only highlights a borrower’s adaptability but also signifies their financial responsibility, a factor that is significantly rewarded by credit scoring models. Maintaining a healthy credit mix is essential, as it contributes to a comprehensive credit profile, ultimately influencing loan approvals and interest rates.

To effectively establish and manage different types of credit, individuals may consider applying for a small personal loan or a secured credit card to enhance their existing credit portfolio.

It is also imperative to maintain low balances and ensure timely payments, as responsible credit usage fosters trust with lenders and aids in building a robust credit history over time.

Building a Good Credit Score

Establishing a strong credit score necessitates a strategic approach that includes a range of practices in financial literacy, responsible borrowing, and consistent credit management techniques.

These efforts are essential for enhancing creditworthiness over time.

Tips for Establishing Credit

Establishing credit can be accomplished through various methods, including the use of secured credit cards and the adoption of prudent financial habits that promote responsible budgeting and spending behavior.

These tools are especially advantageous for individuals who are new to credit or seeking to rebuild their credit scores, as they provide a means to gradually establish a positive credit history. Plus obtaining a secured card, it is essential to maintain a low credit utilization ratio—preferably under 30% of the available credit limit—while ensuring that payments are made on time each month.

By staying organized and tracking expenses, individuals can mitigate the risk of overspending and foster a strong financial foundation. Furthermore, regularly reviewing credit reports allows individuals to remain informed about their credit status and to identify any inaccuracies that may impede their progress.

Strategies for Improving Credit Score

To effectively improve a credit score, individuals should implement strategies such as ensuring timely bill payments, reducing credit utilization, and managing credit accounts judiciously to demonstrate positive credit behavior.

These strategies not only cultivate a healthy financial profile but also significantly contribute to achieving greater financial flexibility over time.

For instance, making on-time payments is paramount; late payments can adversely affect a credit score for several years, while consistent and timely payments indicate to lenders a reliable repayment history.

Maintaining a low credit utilization ratio—preferably below 30% of available credit—signals to creditors that the individual is responsible in their borrowing practices.

Moreover, regularly reviewing credit reports for inaccuracies can help identify and rectify errors that may negatively impact credit scores, thereby enhancing overall creditworthiness over time.

Maintaining a Good Credit Score

Maintaining a strong credit score necessitates a commitment to best practices in credit management. This includes regular monitoring of credit reports, adherence to established credit guidelines, and an awareness of common errors that can jeopardize financial stability.

Best Practices for Managing Credit

Implementing best practices for credit management can significantly enhance an individual’s credit score and contribute to long-term financial health by emphasizing critical elements such as payment history and credit utilization.

Maintaining a low credit utilization ratio—preferably below 30%—and ensuring timely payments are fundamental actions that contribute to the development of a positive credit history, which lenders highly regard.

Additionally, utilizing credit monitoring tools is crucial, as these tools offer real-time updates and alerts, enabling prompt responses to any changes in credit status or potential fraudulent activity.

Establishing automatic payments or reminders is also advisable to ensure that no due dates are overlooked, thereby further protecting one’s credit profile.

Furthermore, regularly reviewing credit reports is essential; identifying and disputing any inaccuracies can effectively mitigate potential damage to an individual’s creditworthiness.

Common Mistakes to Avoid

Avoiding common mistakes in credit management is essential for maintaining a strong credit score, as errors such as late payments, excessive credit inquiries, and mismanagement of debts can adversely affect an individual’s creditworthiness.

These pitfalls not only diminish the numerical value of a credit score but may also result in higher interest rates and unfavorable loan terms in the future. Many individuals tend to overlook the importance of regularly reviewing their credit reports, which may contain inaccuracies that can further harm their credit profiles.

Recognizing the subtle signs of poor credit management, such as reliance on credit cards for daily expenses or the absence of a diversified credit mix, can give the power to individuals to take proactive measures. By establishing reminders for bill payments and controlling credit usage, individuals can cultivate healthy credit habits, thereby ensuring a more secure financial future.

Frequently Asked Questions

What is a credit score and why is it important?

A credit score is a numerical representation of your creditworthiness, based on your credit history and financial behavior. It is important because it is used by lenders to determine your creditworthiness and whether to approve you for credit or loans.

How can I build a good credit score?

To build a good credit score, you should make all of your payments on time, keep your credit card balances low, and only apply for credit when necessary. It is also important to maintain a diverse mix of credit, such as credit cards, loans, and mortgages.

How long does it take to build a good credit score?

Building a good credit score takes time and consistency. It typically takes at least six months of responsible credit behavior to establish a credit score, and several years to achieve a high score.

What are some common mistakes that can hurt my credit score?

Some common mistakes that can hurt your credit score include making late payments, maxing out your credit cards, closing old credit accounts, and applying for too much credit at once.

Can I check my credit score for free?

Yes, you can check your credit score for free from various credit reporting agencies, such as Equifax, Experian, and TransUnion. It is recommended to check your credit score at least once a year to monitor for any changes or errors.

How can I maintain a good credit score?

To maintain a good credit score, you should continue to make on-time payments, keep your credit card balances low, and avoid applying for unnecessary credit. It is also important to regularly check your credit report for any errors or fraudulent activity.